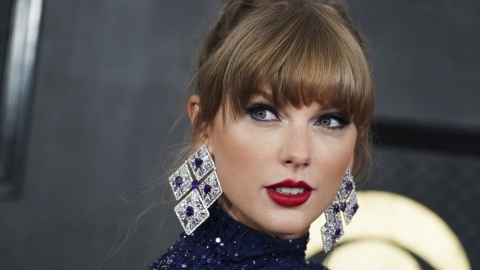

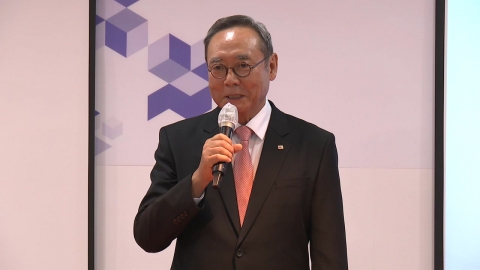

■ Starring: Lee In-cheol, Director of Economic Research Institute,

* The text below may differ from the actual broadcast content, so please check the broadcast for more accurate information. Please specify [YTN News Special] when quoting.

[Anchor]

Let's talk with the head of the Economic Research Institute about how our economic and financial situation will change. I looked at the exchange rate right away. Can you explain why the dollar is so strong now in an easy to understand manner?

[Lee In-cheol]

Perhaps the most notable part of President Trump's entry into the White House is basically Korea's exports and exchange rates. What's more important. It's anxiety that President Trump doesn't know what card he's going to offer. Although the three major indexes broke the record for the New York Stock Exchange, the domestic stock market is starting to fall. It was a painkiller yesterday as well. It started strong and turned weak when the news that Trump was surprisingly doing well, but as you said, the won-dollar exchange rate soared now after winning the U.S. presidential election.

It's surpassing the 1,400 won mark for the first time in 7 months, and yesterday's weekly transaction also hit 1,396 won, and it's trading in foreign exchange until 2 a.m. In night trading, it hit 1405 won per dollar. This means that the fluctuations of the day are getting bigger, and it is the first time in two years that the closing price has exceeded 1,400 won since the FRB strengthened its austerity stance in 2022, and Trump's tax cut policy and fiscal expansion are on top of that. If this happens, the financial situation in the United States is not good. We need to increase the issuance of government bonds, but if government bond rates eventually rise, the dollar will strengthen. President Trump, Republicans have taken control of both the House and Senate. Then, if President Trump decides to do so, everything is possible. The lack of checks is also contributing to the dollar's strength.

[Anchor]

I'll tell you the news that just came in. President Yoon Suk Yeol spoke to Donald Trump for 12 minutes this morning, who won the U.S. presidential election. The presidential office said it would meet with congratulations at an early date. Let's listen to the briefing that was held a while ago.

[Kim Tae-hyo / First Deputy Director of the National Security Office: A phone call was made between Donald Trump and the president of Yoon Suk Yeol. First of all, President Yoon congratulated the president-elect on his great victory with the slogan. In this regard, President Trump thanked him very much and expressed his special regards to the Korean people.

Our President congratulated President Trump on his wish to lead a great America with leadership in the future. The two first continued to talk about cooperation between South Korea, the U.S. and Japan. In the meantime, Korea-U.S.-Japan cooperation has been solid day by day, and this cooperation was able to be established as a three-way cooperation system of Camp David, which was attributed to President Trump, who strengthened cooperation between Korea, the U.S. and Japan during Trump's first term in office.

And our president said that the Korea-U.S. alliance will continue to form a close partnership that encompasses security, economy and all areas, and that the president-elect is willing to continue the good cooperative relationship between Korea and the U.S. And in the future, the two countries agreed to build common leadership in the Asia-Pacific region, the Korean Peninsula, and on a global level. And President Trump said he was listening well to President Yoon's leadership. At the same time, he said that the US shipbuilding industry needs Korea's help and cooperation.

We are well aware of Korea's world-class ability to build warships and ships, and we need to cooperate closely with Korea in the areas of repair, repair and maintenance as well as our ship exports, so we want to continue talking with the President in more detail in this area. President Trump and President Yoon talked in detail about the situation in North Korea.

We evaluated the situation with each other about the military trend in North Korea, which is currently sending troops to Ukraine. I also sympathized with the concerns about the tense war situation in Ukraine. The two leaders shared intelligence on North Korea's nuclear capabilities, ICBM launches, and successive ballistic missile provocations, the fall of filth balloons against South Korea, and GPS disturbances threatening the safety of our ships, civilians, and aviation in the West Sea.

We agreed on the need to meet in person and discuss all these issues in more detail, and soon agreed that President Yoon and President Trump will meet at an early date and place. In the future, we will continue the conversation between the camp staff and the working-level staff for details. That's about it. ]

[Anchor]

The presidential office introduced through a briefing that President Yoon Suk Yeol just talked to President-elect Trump on the phone. This morning, we spoke for 12 minutes from 7:59 and President Yoon Suk Yeol congratulated President-elect Trump on his great victory. And President-elect Trump responded by thanking the Korean people and expressing his special regards. And President Yoon Suk Yeol said he sent a congratulatory message to lead a great America. He conveyed the message that the Korea-U.S.-Japan cooperation dialogue was able to achieve this aspect because it contributed to Trump's first term.

He also said he hopes the Korea-U.S. alliance will be promoted to a partnership that encompasses all areas. President-elect Trump stressed the need for Korea's cooperation in the U.S. shipbuilding industry. Meanwhile, President Yoon Suk Yeol is said to have talked with President-elect Trump about trends in Ukraine and dispatch of troops. And the leaders of the two countries agreed to meet at an early date. I'll tell you again. Today, we heard that President Yoon Suk Yeol had just spoken to President-elect Trump, who won the US presidential election, by phone and agreed to meet as soon as possible. I'll tell you again in the news that follows.

Let me come back to the economy and talk about it. Let's move on to FOMC. I think the market is expecting a 25BP, or a 0.25% cut, when the Fed decides on the benchmark interest rate early tomorrow in our time. However, on the 28th, the Monetary Policy Committee is also scheduled. Can you tell me about the prospects of these two meetings?

[Lee In-cheol]

First of all, in the case of the United States, regardless of Trump's will, there are two left this year. At two FOMC meetings, on November 6th and 7th, local time, and on December 18th, interest rates are likely to be cut by 0.25 percentage points each in baby steps. But the problem is our country. It is historically rare to go up and down based on the closing price of 1,400 won. It's about four times. I don't feel like we're in a crisis right now. Despite the big cut in the U.S., only the dollar is going strong, so what did Governor Lee Chang-yong say? The exchange rate became a new variable when deciding the base rate at the last Monetary Policy Committee of this year on November 28.

What does this mean? It symbolizes that the possibility of a rate cut is lower due to the high exchange rate. In order to revive the sluggish economy, interest rates need to be lowered, but a rate cut could rather stimulate a rise in the exchange rate. The rate cut in Korea, which is not a key currency country, will inevitably be a departure factor for foreign investors chasing higher interest rates, which is why the Bank of Korea may have lost interest rates. The issue of this practical theory is not that the problem is to get off one or two months earlier, but rather, when the United States raised it to 5.5% with Big Step and Giant Step, we fixed it for more than a year at 3.5.

If it had been raised a little more, the demand for buying a house would have decreased due to low interest rates. The household debt problem could also have been diluted, and it remains regrettable that if interest rates were to be cut to boost the sluggish domestic economy, they would have more room to cut them. As a result, despite the growth shock, we have to hesitate to lower interest rates due to the exchange rate. There are concerns that the capacity to cancel the exchange rate has been exhausted through the means of interest rates.

[Anchor]

I think the policy response is close, but I will also ask the stock market. We just told you.Ma's three major indexes of the New York Stock Exchange closed at an all-time high, so how do you think they will affect our stock market in the future?

[Lee In-cheol]

Yesterday and today, unfortunately, the U.S. stock market is good, but the Korean stock market is not good. It's the same yesterday.Ma said that the Trump trade is the strong U.S. dollar, soaring U.S. government bond rates, and only virtual assets Bitcoin, Tesla, and Dogecoin are rising. As a result, when President Trump became more likely to be elected in Korea, reactions began yesterday. First of all, protectionism has been strengthened. And as the eco-friendly policy was abolished and the return to fossil fuels was predicted, most of the stocks related to eco-friendly energy for secondary batteries and electric vehicles ran out.

Seeing that it has risen a little, it's a defense stock. In any case, the country will lose all its self-interested and defense bills, and if this happens, the world will have no choice but to work on self-defense. As a result, demand is concentrated, so only the defense industry is benefiting. Korea is also making various efforts to level up to the next level by creating a level-up index. Nevertheless, as Samsung Electronics, the leader of the market, is sluggish, foreigners' outflow of funds continues to accelerate, and in a way, ultimately, supply and demand problems, internal economic problems, and performance problems overlap.

[Anchor]

To put it simply, the Harris trade, which can be called the Harris beneficiary, is lost, and Trump trade stocks are rising, and the environment in which foreigners can receive supply and demand is difficult due to the exchange rate. And the most representative of Trump's pledges is tariffs. Now, all countries have pledged to impose 10-20% tariffs and 60% tariffs on China, but isn't it a big deal for Korea, which lives on exports? What kind of impact is expected?

[Lee In-cheol]

Trump hates even things. All you have to do is live well in the United States. It's not a caution that the whole world lives well in common. As a result, President Trump has been empty of the White House for four years, and the space is emptying. What's the uncomfortable truth? Last year, Korea's trade surplus with the U.S. was the largest ever. It's 60 trillion won. We benefited from $44.4 billion in trade with the United States, and the surplus quadrupled from $11.4 billion in 2017, the last of Trump's first term. Due to Trump's nature as a businessman to the bone, he has no choice but to tell him to spit it out. First of all, if you look at the report by the Institute for Foreign Economic Policy, it's a tariff bomb if Trump's pledge becomes a reality.

If up to 20% is imposed on all imports and 60% on Chinese goods, Korea's exports to the U.S. will be reduced by up to 60 trillion won. The economic growth rate, real GDP, falls by up to 0.67 percentage points. However, the Ministry of Strategy and Finance and the Bank of Korea believe that the growth rate of the Korean economy in 2025 is 2.2%, and the Bank of Korea is 2.1%. However, a 0.67% drop means that Trump may take away a third of our economy. Then, in order to make up for the deficit, it has always been in the red, so we need to look into what cards Trump will take out, and we need to review Trump's first term in power. Trump revised the Korea-US FTA in 2017. At this time, the automobile and steel sectors were fixed to the taste of the United States while demanding renegotiation.

Import 50,000 U.S. cars even if Korea does not meet safety standards. And U.S.-made auto parts have also advanced the tariff grace period. And since Korea's exports of steel to the U.S. are too high, we imposed quotas and imposed tariffs if they exceeded the quota. As a result, the second period will have no choice but to further strengthen the pressure on the Korea-U.S. FTA. If it was automobiles and steel in the first period, the semiconductor and secondary battery sectors increased further in the second period, so the tariff-free quota could be reduced or classified as a tariff target. Also, import what's left in the United States. For example, there is a possibility that imports of crude oil or beef or agricultural and fishery products will be pressured. What's more scary? Trump is anything. The bigger problem is that you don't know when and at what time you're going to take out which card.

[Anchor]

Let me also ask you additional questions about what was said on the phone call between President Yoon Suk Yeol and President-elect Trump a little while ago. He said he needed Korea's help in the U.S. shipbuilding industry, so if you look at the U.S. shipbuilding industry, the Korean shipbuilding industry is doing well and our shipbuilding companies have entered the U.S. warship-related business, right? What kind of help is President Trump specifically talking about?

[Lee In-cheol]

It is not accurate whether President Trump did SOS to President Yoon Suk Yeol about the shipbuilding project or whether President Yoon Suk Yeol talked to President-elect Trump of the United States because he did not catch the writing earlier, but anyway, if you look at the report now, you need a lot of help in shipbuilding. The most important thing in the competition with the shipbuilding industry is that Korea imports a lot of excess oil assets while talking about the transition to fossil fuels, and now we have an upper hand in the high value-added shipbuilding business, but China is taking all of the low-cost cargo ships. Maybe let's strengthen cooperation a little more to check China. I think that's a signal to expand not only to high-tech industries but also to traditional manufacturing industries.

[Anchor]

Listening to what you said, I think it can be interpreted in a way that Korea needs to check China's low-cost cargo container ships as one of the strategies for encircling China. Now, let me ask you about bitcoin. The price soared a lot. Why is it going up like this?

[Lee In-cheol]

I should have bought a bitcoin or two. It exceeded 100 million won per piece. $76,000 last night, in dollar terms. And it is traded at around 104 million won based on won. It went up right away because President Trump's rise was unexpectedly seen at the beginning of yesterday's vote count. It exceeded 100 million won. Dogecoin, in particular, is up 30%. A coin meme made as a joke with nothing about Musk. Why? President Trump claims to be the president of Bitcoin. At the same time, I will reserve Bitcoin as a national strategic asset. At the same time, he announced a roadmap to make the United States a Bitcoin mining powerhouse by promising to support mining. In particular, Gary, chairman of the U.S. Securities and Exchange Commission, who has been tightening regulations on virtual assets, will be dismissed.

At the same time, he is saying that he will establish a virtual asset advisory committee directly under the President to create a regulatory environment for the development of this industry. As a result, some will more than double the number of Bitcoin, which has now surpassed 100 million. There are a lot of optimism coming out. One thing is that I'm a so-called whale with a lot of bitcoin. Anyone With More Than 1000 Bitcoins Is Now At Its Highest Since 2000 There are 670,000 units, and in their case, it's beneficial to sell them anytime. The majority shareholders' volume could come out. Because it's a high-risk, high-return, just because it goes up doesn't mean it's going to go right away, so it seems necessary to judge this calmly and thoroughly manage the risk.

[Anchor]

There are a lot of economic issues, so I think we should talk with them. I was with Director Lee In-cheol. Thank you.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn. co. kr

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Economy

More- There's less than a 1% chance of getting promoted to executives...Distribution industry lowest at 0.3%

- McDonald's "Tomatoes will be served normally from next week"

- 'Won-Dollar Exchange Rate High' Opens at 1,401.1 Won...KRW 1,400 Up and Down

- Coupang "Chairman Kim Bum-seok sells 500 billion won worth of shares...Financial objectives such as taxes"

![[Scene video+] Trump is back... "There will be a big change in the Korean economy."](https://image.ytn.co.kr/general/jpg/2024/1107/202411070833177256_h.jpg)

!["The scariest scenario"...Is Trump Trying To Directly Deal With Kim Jong Un? [Y Record]](https://image.ytn.co.kr/general/jpg/2024/1107/202411070818548013_h.jpg)