The National Tax Service said some YouTubers and mail-order vendors have been identified as false address laundering cases in which they actually do business in Seoul but register false businesses in shared offices outside of overcrowded areas in the Seoul metropolitan area such as Yongin and Songdo to be subject to high tax cuts.

It exploited the fact that if a young man starts a business outside of overcrowded control areas in the metropolitan area, he or she will reduce corporate tax and income tax by 100% for five years.

In addition, it was revealed that hospitals, clinics, academies, pubs, and taxi companies received R&D tax credits without actually conducting research and development activities after being recognized by research institutes.A case of applying for employment increase tax credit by submitting a fake labor contract

was also caught.

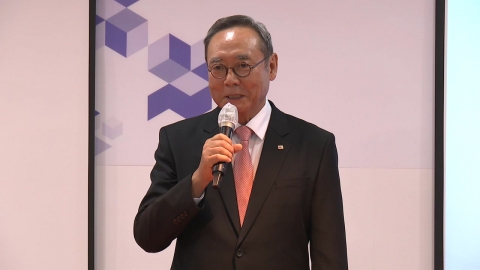

The National Tax Service collected a total of 174.9 billion won last year, including 162.4 billion won for corporations and 12.5 billion won for individuals through tax cuts and follow-up management of employment increase tax credits for small and medium-sized businesses.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Economy

More- Designated as urban convergence special zone in Busan, Daegu, Gwangju, Daejeon, and Ulsan

- The won-dollar exchange rate is around 1,400 won...The stock market is flat.

- Hyundai Economic Research Institute said, "Korea's growth rate during the global tariff war is 1.1%p↓"

- 'Won-Dollar Exchange Rate High' Opens at 1,401.1 Won...KRW 1,400 Up and Down

![Ivanka is "Blue" and Jill Biden is "Red"...What's the meaning of the color of your clothes? [Anchor Report]](https://image.ytn.co.kr/general/jpg/2024/1107/202411071521161633_h.jpg)

!["Let the sink in" Musk's victory celebration?..."Musk's batting is a big hit" [Anchor Report]](https://image.ytn.co.kr/general/jpg/2024/1107/202411071523466148_h.jpg)

![[Exclusive] "Debt Too Controversy" Korean Food University obtained Lee Young-sook's ruling, "17 related lawsuits alone."](https://image.ytn.co.kr/general/jpg/2024/1107/202411071020072123_h.jpg)