The strength of the

dollar has slowed down for now.

After opening the dollar exchange rate with more than KRW 10 lower,

It was trading at 1,386.4 won as of 3:30 p.m., continuing the

drop.

The won-dollar exchange rate, which had surged for two days due to Trump's return to power, took a breather.

[Moon Jung-hee / KB Kookmin Bank Senior Researcher: I think there was a return to resolving the uncertainty (presidential election and interest rate). (However, when he starts taking office), he may move from 1,320 won to 1,380 won because he can go up again when talking about Trump next year.]

If the tariff hike from Trump becomes a reality, prices will rise, putting a brake on the pace of interest rate cuts, and the won will weaken, which could lead to increased currency instability.

The government is also concerned about this uncertainty and has begun to come up with countermeasures.

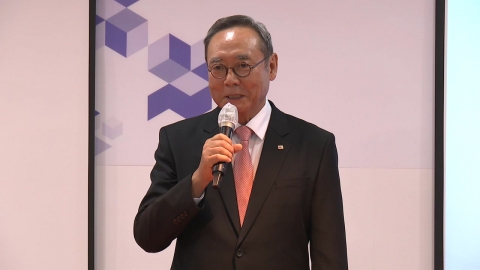

[Choi Sang-mok / Deputy Prime Minister and Minister of Strategy and Finance: Uncertainty exists in relation to global economic growth, inflationary trends, and monetary policy stance of major countries due to strengthened protectionism. Reorganizing the 24-hour joint inspection system of related agencies to the financial and foreign exchange markets....]

The Bank of Korea's agony ahead of the decision on the benchmark interest rate on the 28th is also deepening.

Demand for a rate cut is stronger than ever as inflation is stable at around 1%, and growth is inevitable to lower.

On top of that, the U.S. interest rate cut eased the burden of the Korea-U.S. interest rate gap, but the decision to freeze is gaining momentum as the exchange rate has emerged as a last-minute variable.

I'm Lee Hyungwon of YTN.

a photographer|Yoon So-jung

subtitle news|This line

#YTN Caption News

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

![[Capture News] Bank of Korea's leading variable..."Concerned" by the crumbling won.](https://image.ytn.co.kr/general/jpg/2024/1108/202411082006594697_t.jpg)

![[News NIGHT] Kim Jong Un behind bars?'Advertising' North Korea's Mission to Geneva, Switzerland](https://image.ytn.co.kr/general/jpg/2024/1108/202411082242266011_h.jpg)