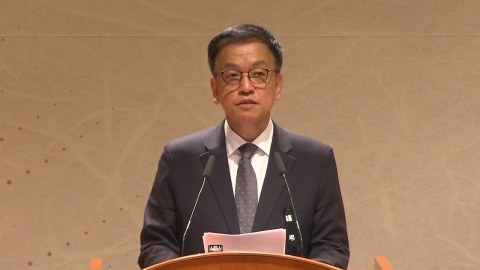

■ Starring: Kim Kwang-seok, adjunct professor at Hanyang University

* The text below may differ from the actual broadcast content, so please check the broadcast for more accurate information. Please specify [YTN News PLUS] when quoting.

◇anchor> You mentioned volatility, which was 46 million won about a year ago last year, 70 million won in September this year and 114 million now. It's very volatile. Nevertheless, they sell Samsung Electronics shares and buy Bitcoin. There's also this kind of talk. How did you see this?

◆Kim Kwang-seok> That's right. Perhaps Korean investors have a relatively large proportion of Samsung Electronics' stock investment. However, there are people who have not seen an opportunity to realize profits by investing in Samsung Electronics for a long time looking for an opportunity to invest in Bitcoin. It can also be seen as a kind of trend. You can think of it as a liquidity market. In the year 25, interest rate cuts will take place in the U.S. anyway. Interest rate cuts are now fluid from a monetary policy perspective, and from Trump's fiscal policy perspective, it can be seen that a huge fiscal input will occur. There's a huge amount of government bond issuance and liquidity through it. Then, the amount of bitcoin is fixed, the amount of supply is fixed, but it will have the effect of limiting it and increasing liquidity. Then, there are people who expect the price to go up relatively and the value to go up. From that point of view, some interpret that such a move to give up the domestic market and choose Bitcoin or the U.S. market is taking place in large part.

◇Anchor> Then why is the domestic stock market so weak right now?

◆Kim Kwang-seok> If we explain in conjunction with Trump's election, we should indicate that Trump is a tariff war anyway. The Man Who Causes the Tariff War, The Tariff War Will Raise Universal Tariffs In Particular This is also an important expression, but the most important target is China. That means we will impose tariffs on China at least 60% and up to 100%. Then the move to keep China in check will eventually haunt the Chinese stock market. Then will it only bother China? It will have a negative impact on the Chinese stock market, but also importantly, Korea, a country with a relatively high dependence on China trade, is the most representative. Then, Korea exports a lot to the United States, but in fact, there are many items that export to China and bypass China, but in fact, if the United States imposes high tariffs on China, the export volume that Korea exports to China will inevitably be greatly hindered. In the end, with Trump's election, the U.S. stock market went up and the Japanese stock market was evaluated well, and the Chinese and Korean stock markets were negatively evaluated.

Excerpted from the conversation: Lee Mi-young, editor of the digital news team

#YRecord

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]