Company money like 'my money'...14 corporate tax audits

You're giving me all the work...Children's wealth 15 times in 5 years ↑

1 trillion won in total evasion...several large corporations worth more than 5 trillion won

Thirty-seven bad businesses and owner families suspected of tax evasion, such as stealing settlement payments to be paid to proxy drivers, buying several supercars under the name of the corporation, and paying hundreds of millions of won for maintaining privately owned yachts to corporations, will be subject to tax investigation.

The National Tax Service said that the total amount of evasion exceeds 1 trillion won, and several of the surveyed companies are large companies with total assets of more than 5 trillion won.

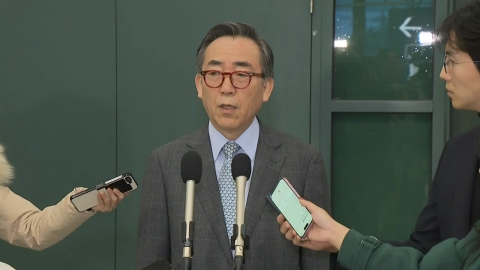

Reporter Oh In-seok on the report.

[Reporter]

Thirty-seven companies and owners' families who use company money for their own money, drive net work, and earn unfair profits from undisclosed corporate information will be subject to a tax audit.

According to the National Tax Service, platform operator A frequently delayed the settlement payment to be paid to the proxy driver.

At the same time, the owner family bought and drove several luxury sports cars under the name of the corporation.

In addition, he paid hundreds of millions of won for skin care and pets with a corporate card, built a private villa on the owner's land, disguised it as a company training center, and collected hundreds of millions of won in rent.

In some cases, corporations were paid hundreds of millions of won for maintaining privately owned yachts in overseas resorts, and their children were rented free of charge.

There are 14 companies that were caught enjoying the company's assets as 'mine', and the amount of assets suspected of using them privately is 55.9 billion won, including luxury houses and villas,

A total of 138.4 billion won, including supercars, yachts, art, and 1.2 billion won for grandchildren to study abroad,

The 16 companies and owners' families who did not report gift taxes even though their children's wealth was more than 15 times higher in five years by driving their work to the "son and daughter" company

}

Companies that do not report related gift and transfer taxes even though their owners' children enjoy listing profits from undisclosed listing information, and their owners have monopolized the gains from rising stock prices with large order information.

[Minjuwon / Director of Internal Revenue Service Investigation: The NTS will launch a tax investigation into alleged tax evasion who monopolizes corporate profits through private interest-seeking management and moral diplomacy. If the charges of evading taxes are confirmed, we will switch to a criminal investigation in accordance with the Tax Offender Penalty Act without exception and file a complaint with the prosecution.]

The National Tax Service said the total amount of tax evasion exceeded 1 trillion won, and several of the companies surveyed were large companies with total assets of more than 5 trillion won.

This is YTN Oh In-seok.

Reporter for shooting

: Jeong Chul-woo

Video editing: Jung Kook-yoon

Design: Lee Won-hee

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Economy

More- BOK to decide key rate today...Interest in the Downward Growth Rate

- Lotte to release Lotte World Tower as collateral for Lotte Chemical

- Trump's 'tariff bombing' forewarning...Korean companies are 'super nervous'

- The first drilling of the East Sea oil and gas field was selected as the 'Great Whale'...Let's get started next month.

![[Focus Y] Can the "Ignore" incident be seen as a "bully" case?](https://image.ytn.co.kr/general/jpg/2024/1127/202411271804218526_h.jpg)

![[On site Y] "My heart heats up watching GOT7 members' performances"...JB (comprehensive) returned after the call-up.](https://image.ytn.co.kr/general/jpg/2024/1127/202411271729128587_h.jpg)