■ Starring: Professor Lee Jung-hwan, Hanyang University School of Economics and Finance

* The text below may differ from the actual broadcast content, so please check the broadcast for more accurate information. Please specify [YTN News Special] when quoting.

[Anchor]

We deliver the latest economic news quickly and kindly. Start Economy, today with Lee Jung-hwan, a professor at Hanyang University's School of Economics and Finance. Please come in. Regarding today's special report, let's first look at the aftermath of our economy after martial law. First of all, the stock market has been hit directly and has been on the decline, but will this instability continue until today?

[Lee Jung-hwan]

It's hard to predict, but I think it's hard to deny the news of increased uncertainty. It is said that uncertainty is an important factor among the factors that determine stock prices, and when the market is uncertain, people tend to delay their investment. In general, if you predict that it will go up, you can easily buy it, and if investment flows are okay, the stock flow is a situation where many investors can gather. If uncertainty increases, it is not something I have to buy today, and if I think the stock price will fall out of anxiety, I can predict that uncertainty is negative. Recently, there have been opinions that foreign investors will gather again because SK Hynix and Samsung Electronics will have a good dividend income, but if Korea's politics becomes unstable, foreign investors are also more likely to become anxious than us. That's why investment is delayed. Only when the price of blue-chip stocks goes up can the index be raised overall, and it can be understood that the burden of such things is increasing. The exchange rate is the same, but I understand that it closed below 1410 won yesterday morning after going near 1450 won. The growing uncertainty can be seen as a story that the exchange rate has also increased volatility, and if these are not resolved quickly, investors' sentiment will inevitably shrink and the flow of foreign investors will also be negative.

[Anchor]

The shock wave of martial law declaration has also affected the business world. I think there's been news all night, with emergency presidential meetings being held and all scheduled business trips being canceled.

[Lee Jung-hwan]

I think it's very important news, and large companies are already global companies, and the characteristic of global companies is that people who buy goods or people who want to invest are all foreigners. If you are a foreigner and do not brief in such a political situation, investors will withdraw money or if martial law is imposed on product transactions, you need to explain whether the contract you promised to procure or not be fulfilled. Therefore, situations where uncertainty grows can be considered a very important issue. In particular, politically, situations such as martial law can cause problems in production itself, so it is necessary to explain the people who live by saying that they are investors and customers. Therefore, you can understand that management has no choice but to gather because it is necessary to analyze the situation and accurately respond to how to convey this analysis. This situation is not the end, but what will happen in the future, but we have to show that we can procure our products at the right time and have no problem in producing returns, so we had no choice but to gather urgently. In addition, LG has issues about the safety of workers to the extent that, for example, employees working near the National Assembly are told to invest. If there is a demonstration or something like this that you don't know about, things like working conditions can become problems, so in a way, you can understand that these were forced to hold an emergency meeting to promote the safety of customers and investors.

[Anchor]

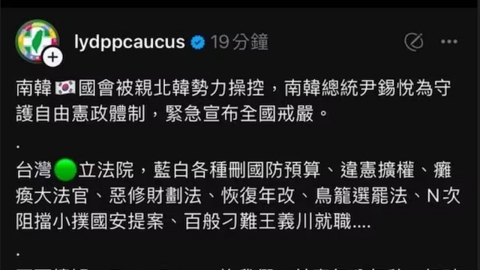

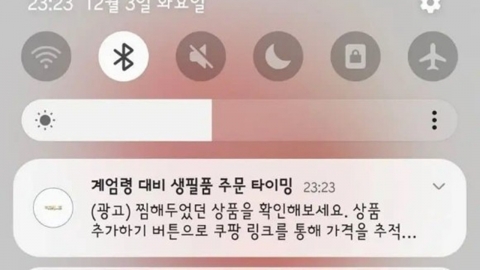

Companies in Yeouido must have been very anxious. And citizens were also very anxious about martial law declared in the middle of the night. First of all, there are people in their 50s and 60s who have experienced martial law in the past. Did you experience trauma or buy a lot of daily necessities, so you rushed to convenience stores and sold a lot of canned goods?

[Lee Jung-hwan]

In the past, many people bought ramen or something like this, but yesterday, canned goods were sold the most. I'm speculating that I might have bought more canned goods that are easy to store in the long run.

But this is not an accurate prediction. Overall, sales of instant rice, bottled water, ramen, and canned goods increased by nearly 300%, which I think is a reflection of instability. In the end, if this political situation becomes unstable, will the supply chain become a problem if the unrest increases or protests increase? If you buy it in advance, you will be able to keep canned goods for a long time, so I can tell you that I tended to buy instant rice, ramen, and other things in advance. However, it seems that there are no more phenomena of hoarding as the psychology stabilizes after martial law is lifted. You consume it out of anxiety, and you consume things that you can hold in the long term. However, as anxiety is resolved a lot in terms of consumption, I can tell you that there will be no such issue in the future.

[Anchor]

I had a night when all the people had to sweep their hearts. I think the aftermath will continue. Financial authorities say they will supply enough liquidity, but there is still a possibility of foreigners leaving funds until the second quarter of next year due to political uncertainty.

[Lee Jung-hwan]

After all, investment is based on profits, but when uncertainty increases, the certainty of investment decreases. It is not necessary for me to invest at this point that the certainty of investment will decrease. For example, I told you about dividends earlier, but I can't do that because my investment is a loss if my stock price falls a lot even after receiving dividends. Therefore, the growing uncertainty may mean that the downside risk that stock prices are likely to fall has also increased, and as a result, there may be a situation in which the flow of foreign investors is not good. Why invest at this point? Short selling is still important in this uncertainty situation, and one of the other directions that can solve the uncertainty is to use a short selling strategy that predicts that prices will fall, but I can tell you that it is not easy to recruit foreign investors because short selling is also banned. In the end, if the uncertainty in stock prices increases, it may rise, but it is highly likely to fall, and in a way, it is said that the possibility of falling is canceled, and the methods of guaranteeing profitability are strategies such as short selling. Since short selling is not available, it is said that the flow of foreign investors has escaped a lot yesterday, but there is a possibility that it may not be good for a long time. In particular, large stocks are heavily influenced by foreign investors, so there may be a negative trend in stock prices. I think I can tell you this much.

[Anchor]

There is also concern that this incident may affect external credibility, that is, the country's creditworthiness. What do you think?

[Lee Jung-hwan]

In fact, I don't think there will be a big problem with external trust. In particular, even when there was impeachment in 2017, S&P or Moody's explicitly stated that the impeachment process itself does not affect our credit rating, so I don't think this itself will have a significant impact, but it evaluates the credibility of the government. Even in S&P and Moody's, we evaluate the credibility, transparency, and risk of the government, and since this has happened once, I can tell you that the factors that can negatively affect it have become clear. The government must be able to manage funds transparently, manage profits, and stabilize economic activities to maintain credibility. Government risks, not economic growth, but government organizational risks will eventually affect credit rating agencies such as S&P and Moody's, and there are actually evaluation items. These things can have a little negative impact. However, I can tell you that it doesn't seem easy to predict a drop in the rating or something like this in the short term.

[Anchor]

We've looked at the aftermath of martial law on the economic market, and next year will be the second Trump system. The analysis that it was within the range of the tariff bomb suggested that the beleaguered Korean economy would be more anxious both internally and externally.

[Lee Jung-hwan]

Trade can be said to be the most important area now, but some people seem to be concerned that the administration's trade function will be paralyzed. Since the heads of the administration have resigned now, when they try to negotiate in the end, someone needs to be a negotiating party, but if the negotiating party is not clear due to other processes or political processes, they cannot establish a negotiation strategy and respond to negotiations. There are bound to be these problems. Until now, uncertainty at the U.S. level has been said to be a big issue, but since the administration's uncertainty is also growing at the Korean government level, the Trump administration should approach the most in January, and respond quickly to how to negotiate trade, solve customs issues, and decide how Korean companies should go to the U.S. and receive subsidies, but it is clear that there are many companies that are worried because the head of the administration or administration officials are likely to not play their role. As these things are quickly resolved, I think I can tell you that we need to create a situation where we have a channel and have exact trade negotiations with the United States.

[Anchor]

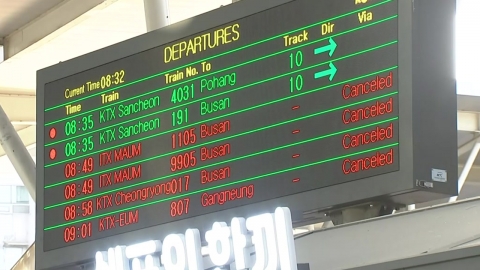

In the aftermath of this incident, the two major labor unions will launch a campaign to oust the president, and the railway and subway will go on a general strike today amid such a chaotic situation. The Seoul Transportation Corporation's union has predicted a general strike tomorrow, so could you point out the issue of the conflict?

[Lee Jung-hwan]

Both sides of the wage, the railroad road is today, and the Seoul Transportation Corporation lines 1 to 8 are tomorrow. The wage problem is apparently the biggest. The Korea Railroad Corporation is asking for a 2.5 percent increase, and the Seoul Transportation Corporation is actually asking for a slightly higher rate than that. As labor and management do not respond well, I think I can tell you that the consultation is breaking down in a way. The second issue is the working environment. So the railway corporation has a lot of deficits. In particular, as Korail has SRT, there are situations in which deficits accumulate a lot, and as a result, supplementation such as essential safety maintenance personnel is insufficient. Or because I'm saying that I'm overworked too much, I'm constantly talking about supplements for that. In the case of the Seoul Transportation Corporation, shouldn't subways driven by one person be excluded? Aren't these situations where at least two people have to respond to problems? Safety issues are also highlighted, leading to continuous strikes. In the end, the issue of wage growth is the problem, and then the Korea Railroad Corporation is safe in such things as management. Next, the Seoul Transportation Corporation can be seen as these aspects of the strike being carried out with these issues as safety in operation becomes an issue. [Anchor] I hope this situation will be easily agreed upon as soon as possible because it is an important means of transportation for citizens, but the union has left open the possibility of dialogue, right? [Lee Jung-hwan] Of course, the union has left open the possibility of dialogue, and especially since the political situation is chaotic, there seems to be a pattern of active cooperation on this.

Nevertheless, the difference of opinion is not easy to narrow. It is easy to raise wages when there is a surplus, but in the case of Korail, the deficit continues to accumulate, so it seems that there are definitely aspects that are difficult to negotiate easily in terms of wages. It would be nice to see these aspects that rise rather than inflation, but I think I can tell you that these issues overlap because if deficit companies raise wages, they will have no choice but to bear the burden.

[Anchor]

I hope that an agreement can be reached smoothly. Let's talk about the issue of Samsung Electronics' reorganization. The reorganization of regular executive personnel in 2025 has been completed. Where should I focus on it?

[Lee Jung-hwan]

You can think of it as the biggest issues came out last week. We are continuing to talk about the semiconductor business by showing that we will actively operate the semiconductor department by making it a kind of presidential system. There are three major semiconductor fields that can only be said. There are semiconductor fields that can occur in AI chips with good technology such as memory semiconductors, very high-end semiconductors, and HBM, and legacy semiconductors can be considered automobiles or general memory semiconductors, and foundry production is a field that commissions production of other system semiconductors. Everyone is saying that the Korean economy itself is a crisis. Competition in HBM and high value-added semiconductors will intensify in the future. SK Hynix is producing a lot, but Samsung Electronics has to keep up with them by lowering prices, and it's a little problem because price competitiveness is intensifying in the future and there are situations where they can't actually make it. Next, there are opinions that China's pursuit of Booyoung Semiconductors is going enormous and that the market for them will be taken away, and it is true that foundry is suffering from problems such as yield and quality control. This sense of crisis is very serious and Samsung Electronics is trying to solve this problem, so it can be said that they are giving special attention to the semiconductor field and AI field.

[Anchor]

I think we use the expression Samsung Electronics in crisis a lot, but there are many difficulties, but in light of this personnel reorganization, how do you expect to overcome the crisis in the future?

[Lee Jung-hwan]

Samsung Electronics' strategy itself focuses on the memory semiconductor field and focuses on improving management efficiency by reducing costs and further developing the foundry business mentioned earlier. What that means is that we were going to invest together now, but we were going to invest in foundry and memory semiconductors at the same time, but we can understand that we have a big strategy to slow down investment in foundry and instead focus on investing in memory semiconductors and success in high value-added memory semiconductors such as HBM. The success of this is that things like HBM semiconductors I mentioned earlier need to be configured to meet Nvidia's requests quickly, and Nvidia is the company that uses them the most. If these things are done quickly, it can go in a positive direction that will lead to cost reduction and future investment. Since the strategy itself has already been established, we are heading to organizations that are trying to implement the strategy itself, and whether this strategy succeeds is the issue of how quickly things like high value-added memory and HBM semiconductors that I mentioned earlier can enter mass production.

[Anchor]

We'll see how the strategies are implemented in the future. Finally, let's look at the results of the New York Stock Exchange. I think they're all closing higher now.

[Lee Jung-hwan]

It's almost like Santa Rally, and it's constantly rising to the point where there's talk that it's a start, and there's talk that it's a new record high, but it went up a lot yesterday. Dow, S&P, and Nasdaq rose a lot, especially in technology stocks. The biggest news yesterday was Powell's remarks, but the economy is not bad. Saying that the economy is stronger than expected, it can be considered that it has shown signs of boosting the stock market while dispelling concerns about a recession, and saying that the economy will not slow down, it is showing positive responses in the AI and technology sectors. Of course, the rate of lowering may be slow, but concerns about the recession were more serious, and it can be said that Chairman Powell has shown signs of stock prices rising as he resolves them.

[Anchor]

We've even looked at the news of the New York Stock Exchange. So far, I've been with Professor Lee Jung-hwan. Thank you, professor.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn. co. kr

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Economy

More- It's not cheap just because it's a PB product. You have to check it out before you buy it.

- If the impeachment process enters, the nation's credibility will be lowered? "You should avoid extreme thoughts".

- Choi Sang-mok "Increased uncertainty at home and abroad...Work with concentration and tension"

- The Economic Institute said, "Don't be complacent about the possibility of a financial crisis due to massive outflow of trade capital."

![National power shaking over 'President Yoon's defection'...Chin-yoon vs. "Witness" in close conflict. [Y transcript]](https://image.ytn.co.kr/general/jpg/2024/1205/202412051014331620_h.jpg)

![[On site Y] Producer Jang Siwon of "The Greatest Rugby" "A cast member of the sexual assault controversy? Of course, it's edited.](https://image.ytn.co.kr/general/jpg/2024/1205/202412051250252611_h.jpg)

![[Site Y] "105 microphones, 140 cameras"..."The Greatest Rugby" (Roundup) that can't be more realistic than this.](https://image.ytn.co.kr/general/jpg/2024/1205/202412051234289175_h.jpg)