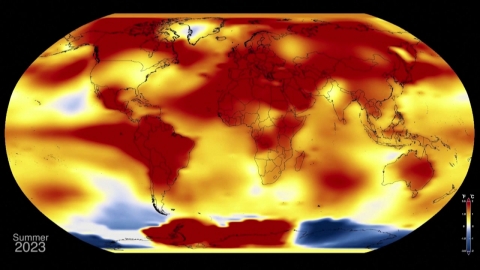

It is a service that allows you to estimate the estimated tax amount for next year's year-end tax settlement based on the results of last year-end tax settlement and the amount of credit card use by September this year.

You can check in advance the increase or decrease of personal deductions and credit card or medical expenses deductions due to changes in annual salaries or dependents this year, and maximize tax savings by adjusting the spending plan for the rest of the year.

For example, if your credit card usage exceeds 25% of your total salary, you can mainly use check cards with high deductions and increase your traditional market consumption, which can lead to greater income deductions.

The National Tax Service is likely to meet the deduction requirements by analyzing individual year-end settlement history, but it plans to extract 430,000 workers who have never been deducted and provide "customized guidance" on seven major items.

In addition to mortgage loans, lease on a deposit basis loans, housing subscription savings, education expenses, income tax reduction for small and medium-sized businesses, monthly rent, and donations.

The National Tax Service said that through a message sent to KakaoTalk on the 20th, you can check the deduction requirements and necessary evidence provided by the National Tax Service's website, and you can also check it in the 'year-end settlement preview'.

If Kakao Talk is not delivered, additional information will be sent to Naver's electronic document.

As this year's tax law amendment was not passed, the year-end tax deduction, the increase in credit card consumption, and the increase in the deduction rate for traditional market use were not reflected in the year-end tax settlement preview.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Economy

More- Overseas Travel Card Stolen Warning "Set safe in advance!"

- I changed the sign and refurbished it.Construction Industry Brand Differentiation Competition

- November 22nd is Kimchi Day... "Supporting sustainable growth of the kimchi industry."

- Binggrae, division of personnel in May next year... "transition to holding company system"

![[Capture News] State-of-the-art air defense network built solidly in Pyongyang...Military surge 'anxiety'](https://image.ytn.co.kr/general/jpg/2024/1123/202411230846258282_h.jpg)

![[YTERVIEW] "The best song is 'Dreams of Octopus'". Thank you, children".](https://image.ytn.co.kr/general/jpg/2024/1123/202411230800271881_h.jpg)