■ Starring: Kim Kwang-seok, adjunct professor at Hanyang University

* The text below may differ from the actual broadcast content, so please check the broadcast for more accurate information. Please specify [YTN News PLUS] when quoting.

[Anchor]

Uncertainty in our economy has been growing since Trump's re-election success.

All major currencies are weakening due to the strong dollar phenomenon, but the won's value is falling significantly and the stock market is also negative. Let's take a look at the related information with Kim Kwang-seok, an adjunct professor at Hanyang University. Please come in.

Korea Decount, which is undervalued in Korea, seems serious. This year, the value of the won fell 7.92% and 8% against the dollar, but the yen was the only one that fell more than ours.

[Kim Kwangseok]

In the end, exchange rates, so do you prefer the Korean won or the dollar in the foreign exchange market? This is going to express the fundamentals of the country's economy. In the end, it can be seen that the fundamentals of the Korean economy, which are evaluated in the foreign exchange market, are relatively negative. The U.S. economy is relatively slow as the global economy is called U.S. exceptionalism, but the U.S. economy is fine, so the preference for dollars is concentrated. However, the Korean economy will put more pressure on China during the aftermath, especially the U.S. economy's growth after Trump's election, and the negative assessment of the Korean economy will be reflected more negatively in the foreign exchange market. Trump administration, it hasn't started yet. In the foreign exchange market, these evaluations are reflected in the forex market.

[Anchor]

On the other hand, there have been reports that Trump may suggest the abolition of subsidies for electric vehicles. Also, the U.S. designated Korea as a country to observe the exchange rate, and I think this will have an impact.

[Kim Kwangseok]

As I just told you, no one knows how Trump will negotiate with the world's major countries in the process of starting his administration from January 2025, or how to conduct a hegemonic war between the U.S. and China.Ma says he's going to get rid of electric vehicle subsidies if he only looks at his comments so far, which is devastating. During the four years of the Biden administration, Korean automakers have been working together to cope with non-tariff barriers like the so-called IRA and Chips Act to receive these electric vehicle subsidies, and if all of them come to nothing, it will naturally be negative for the stock market and we cannot be optimistic about the Korean economy.

Those things will inevitably work negatively in the foreign exchange market. Naturally, it is designated as a country subject to exchange rate observation. If you are not a country to be observed and are designated as a watch risk, the so-called watch risk, then you can take measures to stabilize the fluctuations of the exchange rate market, for example, through oral intervention or direct intervention when there is a sudden change in the foreign exchange market, and those things can be cautious. In the end, there may be a judgment that the means to respond to various instabilities in the foreign exchange market will gradually disappear, so they could further change Korea's foreign exchange market. And the best example is today. The won-dollar exchange rate that started this morning started at 1400 won, but the won-dollar exchange rate fell straight and then returned to the 1400 won level. I'm also very nervous about the rapid movement of the won-dollar exchange rate and how these things will move in the short and long term in Korea. There are more and more disturbing factors, so we can evaluate it like this.

[Anchor]

Until when will it fluctuate in the 1,400 won range?

[Kim Kwangseok]

First of all, how will the administration carry out its policies until the Trump administration is established? And how exactly will the Trump administration move, or will it be an assortment? These things aren't decided for sure. Until then, question marks remain, so from that point of view, expectations for the U.S. will swell a little and there will be more negative evaluations of China and Korea, so I would like to suggest that it would be correct to assume that the strong dollar trend will continue until the end of the year.

[Anchor]

If this trend continues, many people are curious about where the economic authorities will set the rudder.

[Kim Kwangseok]

It's very burdensome. First of all, the most representative thing we can think of is winter. From the standpoint of winter, the first thing Korea can think of is a country that does not have a drop of oil. Then, a country that imports all energy resources, various iron and non-ferrous metal resources. Then, from such a country's point of view, if the won-dollar exchange rate is high, it is like having to buy raw materials at a higher price. That's how burdensome it is, and then when import prices rise, Korea's consumer prices reflecting it will inevitably rise. Such a phenomenon can be judged to be difficult to cut interest rates when it is judged that it is necessary to cut interest rates in a relatively short time to stimulate the domestic economy, from the perspective of the Monetary Policy Committee. So those things, as a result, they need to cut interest rates considering the other various conditions, but they can judge that it's difficult to cut interest rates because of each dollar, which also hinders monetary policy decision-making. So, it can be interpreted that it's not just one or two problems.

[Anchor]

Since the foreign exchange market is in such a state of turmoil, the financial authorities will convene a meeting to check the foreign currency liquidity situation at 10 domestic branches of commercial banks and foreign banks on the 20th of the day after tomorrow. What do you think? What measures will be taken?

[Kim Kwangseok]

More carefully than ever, this so-called concept is called monitoring, and such movements to monitor sudden fluctuations in the foreign exchange market should be more active. The government, the financial sector, and the various sectors of the company are changing rapidly. I don't want to assume that this sudden uncertainty in the foreign exchange market can eventually lead to instability in the soundness of the foreign exchange. But the worst case scenario is that we have to monitor where the wrong link will be negatively linked and carefully monitor financial instability so that such risk factors do not spread to our real economy.

[Anchor]

If the interest rate cut is delayed due to the high exchange rate, there are many concerns that it will be difficult to recover the sluggish domestic market.

[Kim Kwangseok]

I'm most worried about that part. So what is the most vulnerable part of diagnosing the Korean economy? This is the delay in the recovery of the domestic economy. Express that it is more difficult than the IMF financial crisis. It's harder than the IMF financial crisis, so as a researcher who studies the economy, I don't think the IMF financial crisis can be harder just by looking at the numbers. But if you think about it to sympathize with the IMF, why is it more difficult? If I dare to compare it to a boxing match, if I get knocked out in the first round, there's actually nothing more difficult than that, but I don't know if I'll return to my daily life the next day. But if you keep getting beaten during the 12th round, you'll get beaten up. But I don't get knocked out. Then, after the 12th round, you won't be able to return to your daily life for a month.

Since the difficult economic situation has been prolonged since 2020, I think I can sympathize with it in that it is more difficult than the IMF. The domestic economy is difficult, and 1 million self-employed people are going out of business, and 1 million is not just a simple number, but 22 million in terms of the number of households in Korea. Out of 22 million households, 1 million households of self-employed people will close their businesses. This is a really serious situation. It symbolizes the sluggish domestic economy. If I can emphasize to you with the increase/decrease rate of the retail sales index, it is the negative increase/decrease rate for three consecutive years until 2022, 23, and the first half of 24. This has never happened in the history of our country. That's how sluggish the domestic economy is. Then, in such a sluggish situation, it is actually time for a rate cut, and this strong dollar phenomenon can lead to an uncontrollable risk if the exchange rate rises further. That's why it's disturbing. The Financial Services Commission and the Bank of Korea's Monetary Policy Committee may be evaluating the need to cut interest rates for boosting the domestic economy or other problems, but if the strong dollar continues, we can't use the card to cut interest rates. So I can evaluate that this is a situation where we really don't know what our economy will be like.

[Anchor]

What does this mean when the phrase "signs of recovery in domestic demand" disappeared from the November Green Book of the Ministry of Economy and Finance?

[Kim Kwangseok]

You're right. The so-called "Green Book" is an evaluation of our Korean economy by region. When I evaluated it, not long ago, I put in a cautious phrase about whether domestic demand would recover a little. Then, when the Green Book was recently released, the phrase "erase the phrase" was carefully included and removed as a sign of recovery in domestic demand, which means that expectations have disappeared. This is very important. Should I explain this part? KDI released a forecast for Korea's economic growth rate last week. I set my forecast for next year to 2.0. Of course, I published a book every year through the 25-year economic outlook, and the economic outlook forecast it to be 1.9%.Ma predicted a KDI of 2.0. But it used to be 2.2.

But why did they lower this? If I explain this part briefly, this is an important part. To put it the easiest way, you can stack two Lego blocks. To put it the easiest way. There are two Lego blocks like this. When I stacked two, this height was 2.2 and then decreased to 2.0. Why did it go down? One Lego block contributes to domestic demand, followed by exports and foreign exports. But this export sector also saw that the recovery was difficult to continue. Then, after the middle of 2024, this export will be a little tilted, but domestic demand will now recover in earnest and be supported. Underneath this, the contribution of the domestic sector was a little supported, so it was expected to remain at 2%, and it would remain at 2.2%, but the contribution of the domestic sector is slightly reduced. As it is difficult to maintain the previously expected contribution to domestic demand, it seems that domestic demand is not recovering more than expected. Even if the Korean economy cut interest rates on October 11, there is no recovery in the domestic economy. In fact, if you look at other conditions at the Monetary Policy Committee on November 28, it has become a condition for a rate cut, but it is not easy because of another ambush called the exchange rate. I think that the Bank of Korea's Monetary Policy Committee also has a very difficult homework ahead of it.

[Anchor]

But even if the won-dollar exchange rate falls, wouldn't that hurt exporters?

[Kim Kwangseok]

There are many things to consider. Basically, there are companies that can laugh when the exchange rate falls and there are companies that can laugh when it rises. It is difficult to take all of them into account, but for now, the recovery of domestic demand is an urgent priority. In order to recover domestic demand and boost domestic demand, I think it is necessary to voice more expectation of exchange rate stability in consideration of various policies for interest rate cuts and domestic demand.

[Anchor]

I'll also talk about the stock market. Today, the two major indexes rose slightly.If you look at Ma since last year, the Korean stock market has not been working hard. How do you analyze this cause?

[Kim Kwangseok]

There are a lot of things going on.Ma would like to evaluate that the fundamentals of the Korean economy were particularly poor. So, the fact that the fundamentals were not good is that the domestic economy that I've just mentioned is not good. Especially from the perspective of foreign investors, because stock prices are another factor. There are three major investors, and if you classify investors into three, one is individual investors, institutional investors, and the last so-called foreign investors. When classified like this, only KOSDAQ and KOSPI fell, as you can see. However, foreign investors have evaluated that investment in Korea is not attractive. As such, the Korean economy is not promising in the long run. For example, if aging progresses rapidly, the potential growth rate slows down very strongly, major companies in Korea's major industries, including Samsung Electronics, will focus on promising industries, expect significant results in the semiconductor sector in the AI sector, and in various sectors, foreign investors and individual investors in Korea do not positively evaluate the Korean economy, which can be attributed to the outflow of money from the Korean stock market and the inflow of money to the United States or other countries.

[Anchor]

Shanghai, Hong Kong, Japan, and Taiwan, the same Asian region, all rose to double digits, but we fell almost 9% on the KOSPI, let alone rising. Now, the KOSDAQ has fallen by more than 20%. But how can there be such a difference even though there is a difference?

[Kim Kwangseok]

As a person of the people, I'm really sad about these things. Also, Korea didn't announce any policies, did it? But relatively, China and Japan have announced extreme stimulus measures to respond. For example, the first time in China is stock market stimulus measures, huge stock market stimulus measures. So, we announced policies that allow liquidity to enter the stock market in order to solve liquidity. In the case of Japan, it still maintains lower interest rates than any other country. A move that allows them to be heavily liquid, not just in the U.S. but also in the Japanese stock market. There are parts that can be evaluated as relatively positive contributions to the stock markets of each country, but in the case of Korea, investors were at a crossroads where the funds were withdrawn rather than positively evaluated by investors in the three major sectors.

[Anchor]

Market bellwether Samsung Electronics also rose today. a share buyback and retirement plan You said you would spend 10 trillion won over a year, but where do you get this 10 trillion won?

[Kim Kwangseok]

This part is important. How to raise 10 trillion won? First of all, I'll divide it into domestic and overseas subsidiaries. One of your misunderstandings is that you're not buying back your own shares today, this month, right now. I'm going to buy it in installments over the next year, and I'll emphasize one thing about this. So what are you going to do for a year? It's about defending the stock price. As you can see from the data, from November 15, 2024, to November 14, 25, you acquire 10 trillion won worth of treasury stocks and then incinerate them, so you can think that the price will rise according to the principle of supply and demand. So it's a direction that focuses on defending stock prices. To put it simply, it can be seen as a strategy to increase shareholder value.

But the important thing is how to raise this 10 trillion won. If I answer that, first of all, when I look at it now, there is about 5.59 trillion won in cash or cash equivalents of Samsung Electronics in Korea. And it can be procured from overseas corporations. being able to draw funds from overseas corporations There's more than that, too. Then we can raise about 10 trillion won. Of course, the most we can think of is from a Chinese corporation. Of course, the Chinese corporation has strict monitoring of foreign exchange transactions. So it's hard to bring this money in a short period of time.In the mid- to long-term, Ma thinks that if we consider such plans as withdrawing the Chinese business to some extent, adjusting the size of the business, increasing the proportion of the U.S., and increasing dependence on other countries, my opinion is that we will raise a lot of funds from Chinese subsidiaries, and I think that we will raise about 10 trillion won appropriately through domestic and overseas subsidiaries.

[Anchor]

How high are you going to go, Samsung Electronics shares?

[Kim Kwangseok]

But as I presented the table before, should I show you the table before again, in the big table. First of all, the same movement was seen at that time from 2017 to 2018. At that time, there was about 9.3 trillion won in the acquisition of treasury stocks during the same period, and the stock price fluctuation rate was 9.66%. Please refer to these phenomena as well. It's hard to conclude how much this will go up, but what is the most important remaining gate when you have to take these and other issues into account? Right now, the most exciting thing to look forward to is Samsung Electronics' announcement of a so-called quality test for HBM Nvidia delivery within this year. You may expect a lot of news that the qualification test has passed, but if it has passed, I hope I can come out here and introduce it, but there is news and there is another opportunity in the actual delivery process, so I would like to suggest that those things will raise expectations for a rise in stock prices.

[Anchor]

Let's take a look at the property as well. As transactions decreased, the actual transaction price index fell for the first time this year. Does it reflect the effect of loan regulation?

[Kim Kwangseok]

That's right. First of all, considering the real estate market, it is true that the national average price has reversed its upward trend since mid-2024. However, the reversal of the rise is not a strong rise, but a gentle upward trend that is close to a strong rally. Because it was a modest upward trend, that's why the impact of the so-called Stress DSR Phase 2 financial regulatory measures that have emerged since September, that's downward pressure. It would be nice to think that depending on the force you press from top to bottom, it could go down to minus 0.01%. However, it is affected by the second stage of the stress DSR measure in September and October. Then, if the base rate was cut on October 11th and the market rate fell in November or December after that, there would be things that offset those effects. I would like to suggest that the November statistics will come out in December to see if they bounce back positively when such things happen, so I think the point where these statistics come out will be a watershed.

[Anchor]

Earlier in September, I told you that the actual transaction price index of Seoul apartments fell for the first time this year, but in October, the proportion of Seoul apartment transactions sold at the highest price turned downward for the first time in five months. In addition, the Seoul apartment consumption index continued to decline for three consecutive months. To what extent will this shrinking buying continue?

[Kim Kwangseok]

First of all, September and October will be described as Office Day. It was the month when Office Day was decreasing. First of all, it was a period of Chuseok holidays and holidays. That's why the number of transactions is inevitably reduced compared to the same month last year. So you need to understand that it has a seasonal effect. And in September and October, the base rate was cut on October 11, so there was no decline in the market rate. Since September, the market interest rate has gone up. Originally, market interest rates fell first before the base rate cut, but rather rebounded from the previous month of the base rate cut. And by the time of the next cut in the benchmark interest rate, the market interest rate falls again. Originally, there are usually such proactive characteristics, so the impact of a rate cut has not yet appeared in the real estate market. Therefore, only downward pressure on loan regulation has affected the real estate market, and there has been no impact on interest rate cuts. That's why the real estate market you just mentioned will appear. I would like to suggest that you can distinguish the characteristics of the real estate market more clearly if you take a look at how the so-called offsetting real estate market develops as the impact of the base rate cut in November and December is reflected and the impact of loan regulations is offset together.

[Anchor]

I see. We talked about economic issues with Kim Kwang-seok, an adjunct professor at Hanyang University. Thank you.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn. co. kr

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Economy

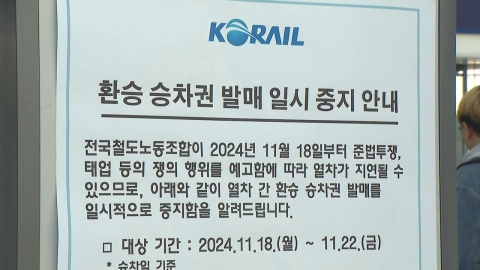

More- Postponement of the railroad union until the way home from work in the Seoul metropolitan area

- Traditional liquor is going on 'K-Wind'...But the reality is "David and Goliath." [Anchor Report]

- Samsung Electronics Co., Ltd.'s KOSPI and KOSDAQ Rise Together

- The railroad union is expected to delay the operation of the subway on the way home from work.

![[G-Star 2024] 210,000 people visited G-Star, "Successful Finishing"](https://image.ytn.co.kr/general/jpg/2024/1118/202411181130300591_h.jpg)

![[G-Star 2024] HiveIM's first outing raises expectations for new works](https://image.ytn.co.kr/general/jpg/2024/1115/202411151733271198_h.jpg)