- Corporate Competitiveness, 'Investing in Technology' TSMC Higher Than 'Buying treasury stock' Intel

- Giheung 20 trillion Investment? Didn't you invest in the meantime? The key is strategy and results

- Samsung HBM's sluggishness is DRAM, and if resolved, there will be HBM6 opportunities

- Samsung Foundry failed 10 years ago 中 The fundamental technology must be refined first.

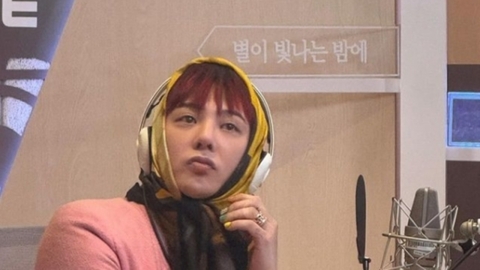

■ Host: Reporter Cho Tae-hyun

■ Air date: November 19, 2024 (Tuesday)

■ Talk: Lee Seung-woo, Director of Eugene Investment & Securities Research Center

- Nokia/Intel Could Be the Same, Negative

- CXMT Samsung Overtaking? Some Media Reports Overhit

* The text below may differ from the actual broadcast content, so please check the broadcast for more accurate information.

◆ Reporter Cho Tae-hyun (hereinafter referred to as Cho Tae-hyun): If you look at the lyrics of Shim Soo-bong's song, "I Only Know Love", There's a part like this. "I cried yesterday, but I'll be happy tomorrow because of you today." There is an item that comes to mind when you combine this song into our stock market. It's Samsung Electronics. It is also the number one stock by market capitalization in Korea. It is also the largest domestic stock held by retail investors. He was also the No. 1 net buyer of Samsung Electronics in the downtrend since the U.S. presidential election. I think it's this atmosphere that only Samsung knows. Shares surged for the second consecutive trading day as the company announced plans to buy back its shares. Our investors cried yesterday, but can we be happy tomorrow? Let's talk by calling Lee Seung-woo, head of Eugene Investment & Securities Research Center. Is the center director here?

◇ Lee Seung-woo, head of Eugene Investment & Securities Research Center (hereinafter Lee Seung-woo): Yes, hello.

◆ Cho Tae-hyun: Yes, hello, director of the center. First, we need to look at the flow of Samsung Electronics. Yesterday, the KOSPI rose more than 2%, and Samsung Electronics had the biggest impact. Can I say this?

◇ [Lee Seung-woo] That's right. It can be seen that Samsung Electronics has played a part in supporting tributaries as it has risen sharply for two consecutive days.

◆ Cho Tae-hyun: Was there any other good news?

◇ Lee Seung-woo: As you all know, we have announced the purchase of treasury stocks. This basically acts as a safety valve to prevent the stock price from falling further. That's how you can see it.

◆ Cho Tae-hyun: Anyway, Samsung Electronics' stock price has started trading at a strong level today and has risen to 56,900 won, so it's right to say that this level is still a lot lower than the appropriate stock price, right?

◇ That's what I think. Since the PBR is only 1x, the stock price has fallen to a level that has never been before.

◆ What is PBR? What's the point of being 1x?

◇ Lee Seung-woo: PBR is the ratio of market capitalization to equity capital value. The current one-fold reflects that Samsung Electronics has little corporate value that can rise further in the future, so it is a little excessive in our view. In the past, even when Samsung Electronics had a deficit, the low point of PBR was 1.1 times. However, in this downtrend, it fell to 0.85 times, so the stock price has fallen to a level that we have not seen in the past. I think that should be considered that way.

◆ Cho Tae-hyun: So overall valuation. Considering its value, it is very undervalued. However, it was also the purchase of treasury stocks that triggered the stock price rebound this time. There seems to be some disagreement over whether it was the right decision to raise stock prices through this share buyback. What do you think of the center director?

◇ Lee Seung-woo: First of all, it's a bit urgent, so I think it's a positive measure for now in that it was actually a measure to prevent further declines in stock prices. More importantly, however, if we think about why Samsung Electronics' stock price fell this time, it's not because we didn't buy back our own shares. In the end, there were doubts about the competitiveness of Samsung Electronics' semiconductor division, and I think that resolving it is a more fundamental direction of processing.

◆ Cho Tae-hyun: Then, first of all, the stock buyback is a short-term rebound factor. Should I understand this much?

◇ Lee Seung-woo: First of all, we're going to prevent the stock price from going down in the short term. As Samsung Electronics will continue to collect the volume of people who buy stocks, it can certainly prevent further declines in stock prices.

◆ Cho Tae-hyun: Okay. According to the report released by the head of the center, it is necessary to reflect on the case of TSMC, which rarely incinerated treasury stock purchases despite the similar situation to Intel, which has been incinerating large-scale treasury stock purchases. ’ What does this mean?

◇ Lee Seung-woo: So in the end, this semiconductor company, especially for tech companies, what's important is technological competitiveness. In fact, TSMC rarely buys its own shares. I'm barely doing it now except for giving it out to some employees, but the stock price has gone up a lot nonetheless. Intel, on the other hand, has purchased about 100 trillion won in treasury stock since 2010. In the end, they took measures to suit the taste of investors who demanded in the short term, but in the process, corporate competitiveness declined, which eventually led to a decline in stock prices. To put it simply, we're going to the bakery. I go to a bakery, and there is a store that makes good bread, and the other thing is that it doesn't taste good, but for example, it provides a lot of other services. If you think about where people will gather, what's important in the end is that buying treasury stocks is a good thing to say, but it's more important to secure technological competitiveness than that.

◆ Cho Tae-hyun: To put it in a rough way, it would be better to spend more on technology development rather than spending a huge amount of money on treasury stock purchases. Can I look at it like this?

◇ Lee Seung-woo: That's why it's not a bad thing to buy back shares. It's not a bad thing to say, but the backside is that the stock price can rise only after the technology has sufficiently supported it.

◆ Cho Tae-hyun: Okay. We're continuing to talk about Samsung Electronics. The frustrating thing is that only Samsung Electronics continues to have bad situations. SK Hynix was good, and stock prices were good in TSMC and Nvidia, which you mentioned, but Samsung Electronics is the only one in winter. What do you think about the opportunity to keep up with this gap?

◇ In the end, Vice Chairman Jeon Young-hyun wrote an unusual letter of apology this time. I think there will be an answer. So in the end, I will try to change the atmosphere of the company and strengthen the technological competitiveness, that is, strengthen the foundation. And what's important is not the content of the letter of apology, but the ability to execute it. So if you do it well, I think there is an opportunity to change direction because there are basic fundamentals that Samsung has.

◆ Cho Tae-hyun: Okay. If so, in the end, it can only be seen that restoring technological competitiveness is important, but it seems that Samsung Electronics calls it 'NRD-K' a state-of-the-art complex R&D complex for preoccupying semiconductor technology in Yongin Giheung. What kind of event did you hold in this regard, and how did you feel about this part?

◇ Lee Seung-woo: It's not that Samsung hasn't invested in the meantime. I invested a lot. In the end, however, the important thing is how to operate the system and software in it and really extract the results. In addition, the ability to judge the management's market or the flow of technology determines Samsung Electronics' future direction.

◆ Cho Tae-hyun: So, I also announced that the investment amount was 20 trillion won by 2030, but of course the investment amount is important, but there are more important parts than that. What else would you like to order?

◇ Actually, there are a lot, but it's kind of weird for me to say this publicly on a broadcast. I'll prepare an opportunity to tell you later.

◆ Cho Tae-hyun: Can I look forward to the report?

◇ There are parts that I can't even write in the report. So I'll visit you later and tell you.

◆ Cho Tae-hyun: Let's look at the semiconductor situation a little bit more. In more detail, the fact that Samsung Electronics' stock price fell is this part that has not secured competitiveness in high-bandwidth memory HBM. However, if you look at the performance announcement in the third quarter, you said that there was a significant progress, so how is there a change?

◇ Lee Seung-woo: We understand that there is a change. To put it simply, what the market wants is not that Samsung Electronics is rushing to talk in ambiguous terms, but whether or not to put a product in Nvidia is important.

◆ Cho Tae-hyun: Did you pass the qualification test or not?

◇ Lee Seung-woo: As far as I know, we're actually putting in the product right now. But the important thing is whether or not the product you put into Nvidia is Nvidia's main product. There may be some controversy in that area. I'll tell you that much.

◆ Cho Tae-hyun: So really important products. There may be problems such as whether it goes into Blackwell or these products or not.

◇ Lee Seung-woo: Yes.

◆ Cho Tae-hyun: Okay. Then, if we go to the next generation, what do you think there will be opportunities for Samsung Electronics in 6th generation HBM and HBM4?

◇ Lee Seung-woo: First of all, Samsung said it would solve the fundamental problem and strengthen its competitiveness, which Vice Chairman Jeon Young-hyun said this time, but I think that's important. So the fundamental problem, why Samsung's HBM is so delayed and not working well this time, is not a problem with HBM packaging technology, but rather a problem with DRAM itself in our view. For example, there is a limit to making delicious food with bad ingredients. However, in our view now, the raw material, that is, DRAM itself, had a problem, and there were various difficulties because of it, but when that is solved, HBM4 eventually changes its technology in many ways from the existing HBM3. So if the problem is solved, I'd like to say that there is a chance to make it.

◆ Cho Tae-hyun: I don't know if you can tell me this part, but there is a problem with the DRAM itself. This means that there is a problem with the competitiveness of memory semiconductors that Samsung Electronics has boasted. What do you think was the problem?

◇ Lee Seung-woo: It's actually been in the media many times, but for example, we talk about 10 nanometers like 1x, 1y, 1z. Since 1x, there have been quite a few media reports that some server DRAMs have been partially returned. Since then, there have been parts like this that were not like Samsung Electronics before, and then the next generation 1a, b, and c, and in 1a, the world's first development was reversed by Micron. In fact, Samsung Electronics swept all the world's first semiconductors related to semiconductors, but there were parts that were slightly different from the past. In the end, it seems that there was a part that was in contact with yield and quality issues.

◆ Cho Tae-hyun: Then shouldn't we not just see HBM as a problem for now, but rather see that there is a problem with the so-called legacy semiconductor industry?

◇ [Lee Seung-woo] That's right. So the fundamental problem that Samsung is talking about. In the end, that's a problem with the technology of DRAM itself. In this regard, a lot of people have recently mentioned China's CXMT, and the atmosphere is not good. In my opinion, the CXMT is coming up a lot, of course, but it's a little exaggerated. That's why we shouldn't pay attention. Of course, we should be wary of CXMT, but I think some media reports themselves are interpreting it a little too much.

◆ Cho Tae-hyun: By CXMT, are you talking about Changsin Memory in China?

◇ Yes, yes, that's right.

◆ Cho Tae-hyun: Okay. Let's look at Samsung Electronics' business one more time. Foundry. This is a situation where the gap with the No. 1 TSMC is widening and the deficit is continuing. How do you think it's appropriate to take the foundry strategy?

◇ Lee Seung-woo: The same goes for this part, but in fact, I think the strategy has already started to fail 10 years ago. It's accumulated and there's a lot of deficit right now, but I think it's more important to adjust the fundamental skills before discussing strategies.

◆ Cho Tae-hyun: I think it's a situation where we have no choice but to tell a very fundamental story. In this situation, we need to pay attention to Nvidia, the world's No. 1 company by market capitalization. The earnings release is scheduled for this Thursday. How are you looking at it?

◇ Lee Seung-woo: For example, last time we had about $30 billion in sales. This time, it is expected to increase by more than 10% to about $34 billion, so Nvidia's performance itself is expected to continue to be good and exceed expectations. The important thing is actually not that, but rather the issue related to fever in Blackwell, which is now an issue yesterday and today.

◆ What is it about? Overheating Blackwell?

◇ Lee Seung-woo: Some server products are delayed due to Blackwell's fever problem. Nvidia shares fell yesterday amid rumors that this could affect fourth-quarter earnings. However, I think it will be more important how Nvidia will officially explain that part.

◆ Cho Tae-hyun: There is a Blackwell issue in Nvidia. Also, we will talk a lot about what kind of things we will talk about after the third quarter earnings announcement, so there may be hints related to Samsung Electronics here. We'll have to wait and see what's going on. In fact, we've talked about many things so far, but I think the most interesting part for those who are listening now is the stock price trend of Samsung Electronics. Many people say when it will be 70,000 to 80,000 won. What do you think about the mid- to long-term outlook?

◇ There's only one thing I keep telling you. It's technology. If the competitiveness of technology is restored, it can rise sufficiently considering this potential of Samsung Electronics. When looking at the stock price growth of major semiconductor companies around the world after COVID-19, Samsung Electronics is second from last place. Since it's that sluggish, this is not the Samsung Electronics we know. So, if we restore our fundamental technology, we can go higher than that. However, if that doesn't work, I can't say that if this company does something wrong, it's really important and there's no possibility that it could stagnate a little more in history like Intel and Nokia in the past. So what's important is that it's more important now to show how much the stock price is going to go right now, but to really recover competitiveness.

◆ Cho Tae-hyun: So what can we judge this by as a sign that this fundamental technological competitiveness has been restored?

◇ Lee Seung-woo: Of course that's going to take time. Because just because something has changed doesn't mean that it suddenly comes out at once with performance. But we've been listening to the atmosphere of people inside Samsung Electronics. Then, the company started to change. If we detect these signals, I think the tone of the analysts' reports will change a little. So, it's actually an official report right now, and we're all buying. Samsung Electronics. I'm writing a bio-report, but if you read between the lines, there are a lot of negative nuances. I think those changes are the signals.

◆ Cho Tae-hyun: Okay. Lastly, I'd like to ask a question from our listeners. He is an individual shareholder of Samsung Electronics who came in at 80,000. "You said there are many things you want to order from Samsung, so please tell me at least one thing. Please. That's what she sent me. If you could tell me one thing, what would it be?

◇ That's why I keep telling you this. I haven't said much else and I think I need some fundamental changes. In fact, if you keep the current system in its current form without change, it won't change. Then there's a high possibility that we'll go like now. So I think we need to make a lot of changes.

◆ Cho Tae-hyun: It's a very obvious story, but he's continuously telling us a very important story. We look forward to recovering fundamental technological competitiveness someday. So far, I've talked with Lee Seung-woo, head of the Eugene Investment & Securities Research Center. Thank you for talking today.

◇ Yes, thank you.

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Economy

More- [NewsNow] Samsung Electronics' 'buy treasury stock' card that it took out for the first time in 7 years...What's the view?

- Costco Korea to receive 150 billion won in dividends this year..."67% of net income for the current period"

- 62.4% of married women under the age of 55 'working mothers' are the highest ever.

- Bank mortgage loans 'highest' ever as home sales increase

![[Exclusive] An annual rate of 5,000% and a family relationship certificate...The prosecution and police crack down on illegal bonds as if they were laughing at each other.](https://image.ytn.co.kr/general/jpg/2024/1119/202411190904368048_h.jpg)

![[On site Y] "Don't regret participating in 'Universe League'"...Sincerely to the 42-member minority elite (Roundup)](https://image.ytn.co.kr/general/jpg/2024/1119/202411191127094512_h.jpg)

![[G-Star 2024] 210,000 people visited G-Star, "Successful Finishing"](https://image.ytn.co.kr/general/jpg/2024/1118/202411181130300591_h.jpg)

![[G-Star 2024] HiveIM's first outing raises expectations for new works](https://image.ytn.co.kr/general/jpg/2024/1115/202411151733271198_h.jpg)