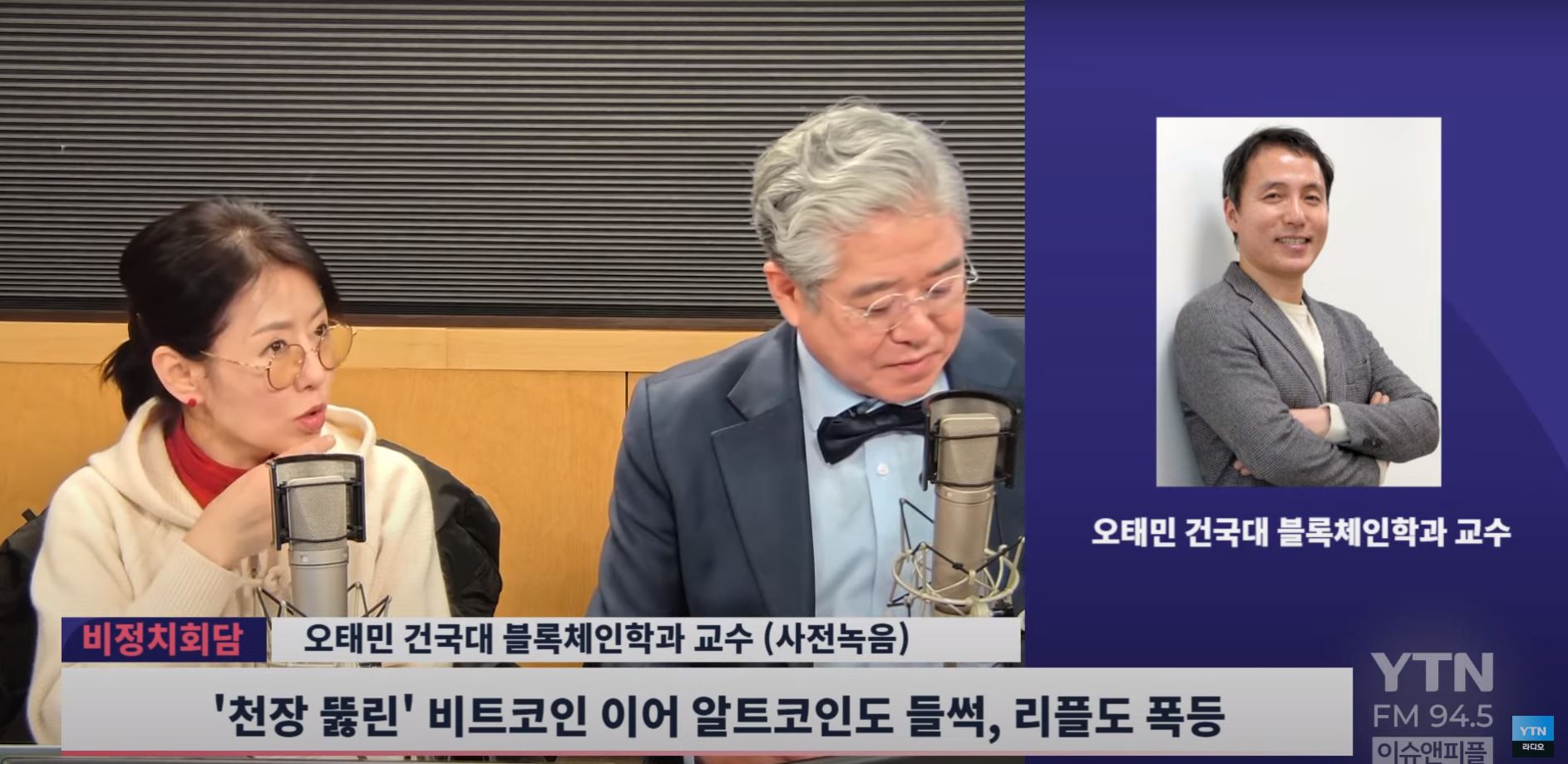

□ Broadcast date and time: November 18, 2024 (Mon)

□ Host: Lee Ik-seon, Choi Soo-young

□ Cast: Oh Tae-min, professor of blockchain at Konkuk University

* The text below may differ from the actual broadcast content, so please check the broadcast for more accurate information.

- Bitcoin to hit $100,000 by the end of this year

- Bhutan, the world's fourth-largest Bitcoin holder after U.S.-China 英...When reviewing Bitcoin holdings at the level of the Korean government

◆ Lee Ik-seon: I say everything except political news. Various Eyes Without Sanctuary or Taboos Non-political Talk Today, we're looking at Bitcoin, which is showing a phase change by repeating a reversal. You're a bitcoin expert, aren't you? Professor Oh Tae-min is connected to Konkuk University's blockchain department. Hello, professor.

■ Oh Taemin: Yes, hello.

◆ Nice to meet you. Professor

■ Oh Taemin: Thank you for inviting me.

◇ Choi Soo-young: The reason why the professor is so busy these days is because of this bitcoin. Bitcoin is actually a hot topic everywhere these days, but you must be busy these days.

■ Oh Tae-min: My schedule is synchronized with the price of Bitcoin.

◇ Choi Soo-young: It's linked.

◆ Lee Ik-sun: Looking at the interview articles about the professor, I heard that 10 years ago, so in 2014, when the price of bitcoin was 500,000 won, a large amount of purchase was 500,000 won. Is it right?

■ Oh Tae-min: That's not an interview article, it's just a reporter digging into it. It's a little exaggerated, but it's not that I didn't sell any of the things I bought 10 years ago, but I have a considerable amount. However, there are many times when coins are bad, and when they are bad, there is no place where you call them, so you have to sell them at that time.

◆ Interest line: I see. But you still have it now. And he bought it when it was a little too cheap. This is a fact.

■ Oh Taemin: Yes, it's a fact.

◆ Lee Ik-seon: I'm sure there are a lot of people who are jealous.

■ Oh Tae-min: Yes, I get a message or a call at dawn.

◇ Choi Soo-young: Maybe that's why my professor's voice is calm and relaxed, so I think this is the holding of bitcoin in the background.

◆ Lee Ik-seon: Let's move on to this topic. First of all, how much has the price of bitcoin gone up now?

■ Oh Tae-min: It was flat at around $70,000 just before Trump was elected. It's going back and forth from $90,000 in a week, breaking through $75,000 on the day of the election and $80,000 the next day.

◆ Profit line: $90,000 in a week. I heard that it has surpassed the domestic stock market in terms of market capitalization, is this right?

■ Oh Tae-min: It's higher than the market capitalization of all three Korean stock markets combined. And it outpaced silver. So, we are now competing with Saudi Aramco after Gold, NVIDIA, Apple, Microsoft, Amazon, and Google. for the sixth place

◇ Choi Soo-young: Why is the rally so hot?

■ Oh Tae-min: It's said that Bitcoin is half-life every four years. The income earned by miners is halved. Then, the price will rise significantly after a supply shock and a delay of about six months. This time, however, it was reflected first because Trump was confirmed as the president because Trump made it an election issue, and I think he is reacting like this because it is very meaningful for the United States, not other countries.

◇ Choi Soo-young: In short, the half-life has disappeared and there is a structure that can be marked in the shelf, so in a way, I think we should look at it like this.

■ Oh Tae-min: Yes, it was a time when water came in, but a tsunami happened again.

◇ [Choi Soo-young] That's a very clear expression.

◆ Interest line: I see. But since it was listed on the New York Stock Exchange ETF, it was now incorporated into the system.

■ Oh Taemin: Yes

◆ Lee Ik-seon: From now on, I'd like to see how the general public's perception of Bitcoin has changed, but there were times when I was misunderstood that this was not a fraud. Because Trump said that only dollars are real currencies, and I think we need to look at why it changed so much and the change of mind of those who accept it.

■ Oh Taemin: It's an important point. Bitcoin ETFs were approved on Wall Street in January this year, making it much better for institutions and companies to include Bitcoin as one of their assets. That's why the grades are very good. The net inflow was $30 billion in 290 days. This is now said to be the best record in ETF history. Just enough to achieve it the fastest. It was fast, but President-elect Trump is a record holder in relation to Bitcoin. When he was in office, he tweeted Bitcoin directly and now it's X. When I mentioned it in the tweet, I said it was a scam. The reason why this is a record is that the head of the administration has never mentioned bitcoin himself, and even though he was in a hurry, he said he would buy it, so now there are two titles. He failed to get re-elected. That's how you were investigated a lot. So last year, I took a mugshot while prosecuting in Georgia, and in the meantime, when I was investigated, I issued an NFT saying it was satirical. It's based on Ethereum, and NFTs are a way that we make very expensive pictures or very interesting cats and so on and tokenize the one-of-a-kind pictures. If you make your mugshot into an NFT and sell it for $99 and buy a lot of it, you come to your Florida mansion and eat together. So I didn't raise a lot of political funds, but it was symbolic, but I think he changed his mind completely from then on. So in July of this year, he appeared at a Bitcoin conference in the U.S. called Nashville, so don't sell the coin now. I'll upload the bitcoin. He made a joke like this and made a huge amount of remarks. So maybe two sons and two grown-up sons are all involved in this blockchain DeFi. And we call Elon Musk one of the PayPal divisions, and I think that the influence of those friends, including Peter Till, was great.

◆ Lee Ik-seon: But it's actually very unique. Taking a mug shot is actually shameful, but it's hard to understand from our common sense that if you buy a lot, you'll get a chance to eat, thinking about commercializing it and selling it.

■ Oh Tae-min: That's a characteristic of the young people of this era. Whether it's the United States or Korea, this has to be fun. So I don't understand it from the perspective of our older people. I was able to communicate with young people. Oh, this person is really funny. That's what happened.

◇ Choi Soo-young: But now President Trump has vowed to become president of virtual currency and is even emphasizing that he will reserve Bitcoin as a national strategic asset. I think the two things we're really curious about are whether we'll surpass $100,000 and if it's still too late to buy now. How do you see it?

■ Oh Tae-min: That's the hardest question. It is expected to touch $100,000 by the end of this year.

◇ Choi Soo-young: Touch it.

■ Oh Taemin: But you have to be careful. Because this $100,000 is a very important reference point. So if you look at the flow of Bitcoin, $10, $10, $10 million was a huge crisis. So it took at least two years and up to three and a half years to break through 1,000 dollars and 10,000 dollars each. It's going back and forth. So, if it surpasses $100,000 by the end of this year, there is a very high possibility that it will go down to less than $100,000 even after reaching $140,000. So my hypothesis is that you can't go over it at once. The reason is that $100,000 is a great reference point, and whose reference point is that Bitcoin is cheaper than me, so I bought it expensive, but there are quite a few people who bought it less than 10,000 won 12 years and 13 years ago. Their own asset liquidation standard is 100,000 dollars. That's why it's called these whales, and if they pour out their supplies, the institutions will keep the price if they accept it, but whenever it moves, the characteristics of Bitcoin are all visible in other people's accounts. So if the old coin moves, it falls because of the news. Not long ago, 2,000 14-year-old Bitcoin moved.

◆ Lee Ik-seon: Yes, yes.

■ Oh Taemin: We're getting ready to sell now. So it's not too late to go in now. There's something to eat even if you go in now. Until June next year. But you have to watch the timing carefully.

◇ Choi Soo-young: Professor Cham, did you just describe it as a whale who invested in bitcoin in the 10,000 won range?

■ Oh Tae-min: Yes, whale

◆ Lee Ik-seon: What I'm curious about is that you're a little embarrassed, but I'm a bit of an outsider, so I'm going to give you a basic question here. I heard that bitcoin is no longer a printing money. So, I heard that it's not a currency that is printed anymore, but it's limited. Is it right? With limited assets, we're in this situation right now, selling, going up, and down, right? So you're stuck in a series of questions and questions like, is this a currency or is it allowed to invest? Then what's the dollar?

■ Oh Taemin: That's right. I gave a book I wrote to my acquaintances 10 years ago and told them to buy Bitcoin. The problem around me was that there were so many people who studied. So the people who studied have poured out the questions you've just said. How does this become a currency when prices fluctuate like this? And then those who know a little bit about the monetary theory of economics say, "If it becomes a deflationary currency like this, the economy will collapse." And those who have inquiries about money laundering said, "The United States will not let it go because it is used for money laundering." They would have had a lot of luck, but they moved away.

◆ Lee Ik-seon: It's a fault that you're overdoing it.

◇ Choi Soo-young: It's not good to know. This is

■ Oh Tae-min: Those who just listened to me and lived silently are now financially free.

◆ Lee Ik-seon: Are there people like that? Are there people who lived silently?

■ Oh Tae-min: There are a few.

◆ Profit line: Great grace

■ Oh Tae-min: I gained economic freedom and now

◇ Choi Soo-young: Those people are visionaries.

◆ Lee Ik-seon: Anyway, it's on the side again, but yes, it keeps going.

■ Oh Tae-min: But because this bitcoin is a new phenomenon, we don't know yet that we've defined it in our ideas in the past. Because when the Internet first came out 30 years ago, we called it e-mail. E-mail is not wrong, but we can't define the Internet as e-mail right now. The same goes for Bitcoin. There is a figure that mimics currency, but it should be considered a new currency. And when President Trump made a pledge like this, it was because a group finished studying on this and there was a consensus. In fact, some Republicans are quite studious when they come forward with legislation. So it's not President Trump's deviant remark to take Bitcoin as a strategic asset. It became one of the big strategies of the United States.

◇ Choi Soo-young: Stocks and real estate, which are often used as a means of financial technology, actually have a lot of bubbles. When the bubble bursts and the value of stocks or real estate drops really significantly, I think many people have questions about whether Bitcoin can be an alternative as a means of financial technology at that time.

■ Oh Tae-min: It's a very important part. In theory, Bitcoin has to go against traditional assets. Empirically, that's not the case at all. All asset prices plunged in the early days of the spread of Corona in 2020. That's when Bitcoin fell the most. Then, even after the outbreak of the Russo-Japanese War in 2022, Bitcoin fell the most. Then, every time the Middle East war escalated this year, Bitcoin fell. So when market instability rises, bitcoin liquidity is so great that it goes back overnight. So the bombing occurred, but the stock market did not open at dawn, but there was a strange phenomenon of selling bitcoin first, and investors should be careful about this. Those who insist on the principle of Bitcoin say that Bitcoin must have it because it is different from traditional assets, but that is also true, but what actually moves in the market is more sensitive and moves bigger.

◆ Profit Line: So how many Bitcoin do you have in total? What Bitcoin Does Exist?

■ Oh Tae-min: It is expected that 1 million more Bitcoin will be built over the next 100 years. That's why it's fixed at a total of 21 million units. There are only a little less than 20 million right now.

◇ Choi Soo-young: Small South American countries such as El Salvador bought Bitcoin, so the president's popularity is not normal these days. If the U.S. says it will turn this bitcoin into a strategic asset and President Trump will make the U.S. the capital of Bitcoin, in fact, the South Korean government and the Korea-U.S. alliance are important, but shouldn't we consider owning this bitcoin at the government level?

■ Oh Tae-min: Thank you for saying what you really wanted to say. Now, governments around the world are ranked first in the rankings of Bitcoin owned by the government. The second place is China and the third place is England. And 4th place is an unexpected country. It's Bhutan. Bhutan is a really poor country, and it is said that the Himalayas are rich in hydroelectric power. But I don't even use electricity because I'm poor.

◇ Choi Soo-young: That's right.

■ Oh Tae-min: But the prince studied abroad, but he mined Bitcoin without our knowledge. So, with 15,000 hydroelectric power, El Salvador, which you just mentioned, collected only 5,000 altos with state money. I saved it with money. 15,000 were just mined for free with water coming down from the Himalayan mountains.

◆ Lee Ik-seon: What do you mean by that? What do you mean you mined it with water from the Himalayas?

◇ So electricity is

■ Oh Tae-min: Hydroelectric power continues to flow even if we don't use it. When you don't use the remaining electricity, the water just flows, and the electricity is generated.

◆ Profitship: Mined.

■ Oh Tae-min: For your information, Bitcoin mining is a game that uses electricity to match random digits with a special computer. It's an electric game.

◇ Choi Soo-young: I heard that it takes a lot of power.

■ Oh Tae-min: Yes, the more electricity you use, the more likely you are to win.

◆ Lee Ik-seon: I think the understanding will vary greatly depending on the age group of listeners who listen to this broadcast. Some of you may understand what the professor is saying perfectly, but I'm sure there are people who are saying what you're saying. Then, for example, an individual can study and mine with the ability.

■ Oh Tae-min: At first, individuals were mining. But that era ended quickly. Mining is completely industrialized. Isn't there an AI data center? If you use it, AI doesn't just do it, but you have to calculate a lot. That's right, but it's very difficult to find an AI data center. Because in order to become an AI data center, there needs to be plenty of power, and then there is a ventilation cooling facility to order the machine, so it needs to heat a lot. The only place that can do that is bitcoin miners. Bitcoin miners have already solved the electricity. Next, the bitcoin digger also generates enough heat to use for heating. So now it's a cooling system, so when bitcoin prices fall, bitcoin miners work part-time at AI data centers.

◆ Lee Ik-seon: So if you do this in a very cold area, it would kill two birds with one stone.

■ Oh Tae-min: That's too precise. We chose Finland and Norway as the countries that are optimized for Bitcoin mining. The country doesn't need a cooling system because it's cold, but it's also rich in geothermal heat. That's why energy comes out of the ground. That's when the fever comes out. So if you do it with it, you can collect it like Bhutan.

◆ Lee Ik-seon: Yes, I see.

■ Oh Tae-min: But Korea's Korea Electric Power Corporation can also mine bitcoin. This is because our country is nuclear and this is the engine network.

◇ [CHOI SOOUNG] Right, it's going well.

■ Oh Tae-min: A lot of nuclear energy is wasted. Because electricity is not always used at peak times, so when mining Bitcoin, we also collect 10,000 quickly, but the Korean government and bureaucrats have been investing in blockchain for the past decade, seeing Bitcoin as speculation and protecting investors as much as possible. So we see this phenomenon as a technology. So companies went to the blockchain, and all companies eliminated the department without much success in the blockchain.

◆ Profit line: Oh, my.

■ Oh Tae-min: In that flow, the U.S. president is not talking about blockchain, he is talking about virtual assets.

◆ Professor, I'll count to the side one more time. You're a professor in the blockchain department. Are there many applicants?

■ Oh Tae-min: Yes, this is graduate school. a specialized graduate school So I think there will be a lot next year. Because the price has gone up since this year.

◇ Choi Soo-young: That's why I became interested.

◆ Lee Ik-seon: Then the students who produced it?

■ Oh Tae-min: There are no applicants if the price goes down after increasing.

◆ Lee Ik-seon: I see. Then, do the students who produced them stay in domestic companies? Why go abroad?

■ Oh Tae-min: Our students are not regular graduate schools, they are special graduate schools, so they are usually concurrent. Already working

◆ Profitship: I understand.

◇ Choi Soo-young: Now let me ask you something a little realistic. Bitcoin is now more expensive in Korea, so there were a lot of comments such as kimchi premium. But now, there is a saying that it is cheaper to buy in Korea, is this true?

■ Oh Tae-min: Yes, the kimchi premium is that we usually went from 10% to 20%. In 2017, it once rose to 40%. So I just went back and forth to Japan and made money risk-free. If you buy it in Japan and sell it in Korea, you just make money. But now, the kimchi premium is either negative or almost zero.

◇ Choi Soo-young: I see.

■ Oh Tae-min: There are two interpretations of this. One is that Korea's exchange rate has risen tremendously right now. So, if the exchange rate has already risen and the exchange rate is expected to fall in the future, considering that the won, which is judged to be already included in the kimchi premium, will be appreciated. That's one thing. One is that corporations are not allowed to invest on our exchanges. They are thoroughly individual investors. So it's also an indicator that individual investors are still less involved in the rise of the coin. Then who the hell is making this rise? This upside means that institutions are making it now.

◆ Interest Line: We are preparing an important question. In addition to Bitcoin, other cryptocurrencies are also showing a strong upward trend, and many people invest in so-called altcoin alternative coins. These days, when you enter the coin exchange Upbit, Dogecoin or Ripple trading volume is higher than Bitcoin. But when it comes to altcoins in the past, I only knew about Ethereum, but there are many people who invest in these altcoins, right?

■ Oh Tae-min: Our country has a lot more alt-coin investors.

◇ Choi Soo-young: I see.

■ Oh Tae-min: There are especially a lot of ripple investors. Recently, there are things that ripple investors will be very happy about. So the ripple went up a lot. Doge is a meme coin related to Elon Musk in the next few days, and people who have Doge and Ripple are very happy right now, right?

◆ Interest Line: So what should I say about alternative coin bitcoin and alternative coins? It's hard to say it's a three-way fight, but how do you expect the weight to change?

■ Oh Tae-min: It's called Bitcoin Dominance right now. It refers to the share of Bitcoin in the total coin. Originally, when the market is bad, this domination tends to go up. Bitcoin Dominus is in the 60% range right now. It's going to fall out now. Up to 40% because now the alt market is expected to start in earnest. If there is anything different from the past, Ethereum is leading the altcoin market. This market is not Ethereum, but Doge and SLP coin names are SLP. So it's kind of unusual to be led by Ripple and Doge, but now the altcoin market is coming.

◇ Choi Soo-young: Ripple is a popular coin in Korea these days. People who have invested in Ripple have lost a lot, so why are you tricked by Ripple again? There's even a new word called "Litto". Why is the price soaring even in this uncertainty or liquidity?

■ Oh Tae-min: I personally bought Ripple for 1,000 won about three years ago. I didn't buy a lot for 1,000 won, but I think I bought a few million won worth. But every time it reached 1,000 won, I sold it for 1,100 won the other day, so I was happy. But the next day, it went up to 1,600 won.

◇ Choi Soo-young: It looks like you're maintaining the 1,500 won level now, right?

■ Oh Tae-min: I was so happy because I waited for 3 years to make it. It's 1,600 won in a few days, so I'm not feeling very good right now. Ripple's high point is 5,000 won. Ripple still has a long way to go. So in Korea, there are quite a lot of people holding ripple for more than 3,000 won. Ripple's representative is Garling House, and he gave a huge campaign fund to Trump's camp. And there was news that he was now involved in selecting a successor to the SEC chairman. Chairman Gary Gensler is now the Democratic nominee. But this person has never been hostile or hostile to Bitcoin or our virtual currency.

◆ Prof. Lee Ik-seon: Let's briefly explain what SEC is and move on.

■ Oh Tae-min: When it comes to our country, it's the Securities and Exchange Commission. Because Bitcoin was in the Securities Department, now the SEC was in charge. So, it is the SEC that creates this proposition that all coins are securities and regulates all coins, and President Trump said that he would replace the chairman of this SEC. He said he'd like to have an off-foot day and a one-day day. That day, I don't know if it's going to be like that or not, but Gary Gensler has said that it's been an honor, so Ripple is excited right now. Chairman Gary Gensler did not suppress Bitcoin or Ethereum, but Ripple certainly did. Because throughout my tenure, I had filed a lawsuit with Ripple as a securities company. That's why Gary Gensler and Outriffle appeared. That's why the formula was made.

◆ Lee Ik-seon: Does the person who developed the coin become its representative?

■ Oh Tae-min: Except for special cases such as bitcoin. Any company or foundation becomes the issuer. So, at first, they issue it and now they receive money by handing over the volume to institutions through ICO or OTC transactions. The SEC sees this investment activity itself as securities.

◆ Profit line: Okay. Then, some predict that the ripple will rise to the 30,000 won range soon, but what do you think? Can I go in now?

■ Oh Tae-min: You have to invest after knowing the biggest difference between Ripple, City and Bitcoin. Bitcoin is known that all transactions are transparent and the volume is quite limited. There is no volume limit on the location. Next, I took so many pictures of Ripple and the initial holders have a lot. I think it hit 100 billion hearts.

◇ Choi Soo-young: That's a huge amount.

■ Oh Tae-min: Yes, so if Ripple's market cap rises a little, it may now exceed Bitcoin's market cap. Then it becomes a mirage. So

◇ [Choi Soo-young] You're right. the real

■ Oh Tae-min: You have to be very careful.

◇ Choi Soo-young: This is really too much to approach in Bitcoin, so we should always consider this as a variable.

■ Oh Taemin: Yes, that's right.

◆ Interest line: All right. A virtual currency renaissance will arrive. It's true that this prospect is coming out and people's hearts are shaking. Can you say something for non-gigans who didn't know or just found out or are in the early stages of investment?

■ Oh Tae-min: Bitcoin is not a phenomenon that will disappear. What's going on in the U.S. right now can be seen as accidental by a character named Trump, but I think it's going to happen one day. Now it's a coincidence that it happened, but it was going to happen one day. As such, Bitcoin is meaningful as a new industry related to national strategy and public welfare. So, from the perspective of investor protection, Korea must quickly switch to a new industry. If you look at it from that perspective, you can see it in the long run. However, if you pay attention to how much money you make in this uptrend right now, it can be seen as a very dangerous time. The price changes so fast.

◇ Choi Soo-young: Trump has been in office for four years. How do you think it is desirable for our country to deal with Trump's policies if he believes they continue for four years?

■ Oh Tae-min: Our country is doing well, too. I put too much into the blockchain, so I tended to be a little bit clumsy about this virtual asset. That's why major Korean companies are not able to touch coins at all. You can buy coins yourself, but issuing coins is one way. If a large Korean company issued a coin, it could have become a global coin. But he didn't create that atmosphere at all. As soon as possible, the atmosphere should change, not from the perspective of protecting investors, but rather to make our K-coin as soon as possible so that Korea can create a model that can link coins and added value.

◆ Interest Line: What conditions do we need to be in place for that?

■ Oh Tae-min: First of all, don't turn off government figures saying, "Watch out for Bitcoin unconditionally." We need to create an environment so that companies can try coins.

◇ Choi Soo-young: Then which department should be in charge is actually one of the issues. We have the Ministry of Economy and Finance, the Ministry of Industry, and so on. Then, which side should handle this problem? Do you think it makes the most sense?

■ Oh Tae-min: This is what happened to the Ministry of Economy and Finance because I've seen a technology called blockchain. Since this virtual asset is one of the financial assets, traditional financial supervisors deal with it, allowing companies to include financial assets in their accounting books rather than intangible assets, and most of all, Korean corporations do not create accounts on Korean exchanges. It's not that they don't make it because it's illegal, but they're wary of the government.

◆ Interest line: I see. It was a very powerful time today that I thought I should study a little bit. With Professor Oh Tae-min of Konkuk University's blockchain department, we listened to the world of coins, including Bitcoin, the investment prospects, and suggestions from the Korean government. Thank you, professor.

◇ Choi Soo-young: Thank you very much.

■ Oh Taemin: Thank you.

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Economy

More- Traditional liquor is going on 'K-Wind'...But the reality is "David and Goliath." [Anchor Report]

- [Issue Plus] Korean Won's Value, Stock Price Fall by 9%...KOSPI bounces 2 percent

- Samsung Electronics Co., Ltd.'s KOSPI and KOSDAQ Rise Together

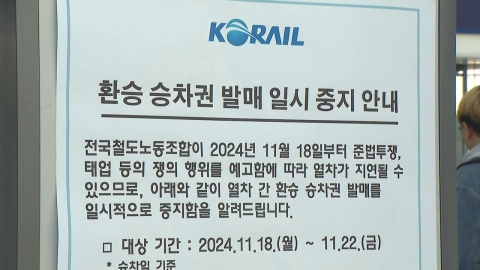

- The railroad union is expected to delay the operation of the subway on the way home from work.

![[G-Star 2024] 210,000 people visited G-Star, "Successful Finishing"](https://image.ytn.co.kr/general/jpg/2024/1118/202411181130300591_h.jpg)

![[G-Star 2024] HiveIM's first outing raises expectations for new works](https://image.ytn.co.kr/general/jpg/2024/1115/202411151733271198_h.jpg)