Let's start the economic pick that organizes economic issues in an easy-to-understand manner.

I'm with reporter Oh Dong-gun. Welcome. Let's meet the first keyword video first.

The stock price has risen a lot today since the announcement that it will buy back KRW 10 trillion of its own shares. What's the closing price?

[Reporter]

Let's clean up a little bit. You'll see it in a graphic way. Samsung Electronics closed nearly 6 percent higher at 56,700 won.

With Samsung Electronics, the top market cap, surging, the KOSPI rose more than 2 percent to close below the 2,470 mark.

KOSDAQ also closed 0.6% higher at 689.55.

Samsung Electronics was trading at 57,500 won at one point, rising by 7%. Last Friday, it closed at 53,500 won, which soared more than 7%. You'll remember it on Thursday, the day before.

In the aftermath of the collapse to the 40,000 won level, the stock price rose as low-priced purchases flocked. Today, it rose nearly 6%, and the winning move of buying 10 trillion won of treasury stocks is working for now.

[Anchor]

I'm curious about the future. How are you looking at the views?

[Reporter]

They kept asking me earlier. Actually, I don't know well, and it's true that experts don't know well.

[Anchor]

When are you going to start buying treasury stocks?

[Reporter]

I'll explain it to you little by little. First of all, to summarize the situation, Samsung Electronics closed at 49,900 won on the 14th, as I told you earlier, due to sluggish performance in the third quarter, weakening competitiveness in high-bandwidth memory, and the prospect of President Trump reducing semiconductor support. It was when it crashed to 40,000 electrons. It was June 15, 2020. At this time, after recording 49,900 won, it fell to 40,000 won in 1,614 days. The market capitalization also hit 298 trillion won, collapsing to 300 trillion won. In this situation, Samsung announced a 10 trillion won share buyback and retirement, and news of the share purchase usually raises the stock price. This is because the number of stocks in circulation decreases by size, but the value of stocks held by shareholders increases, and there have been similar cases in the past.

In 2015 and 2017, Samsung Electronics announced plans to buy back 11.4 trillion won and 9.3 trillion won worth of treasury stocks and incinerate them, respectively, but the plan was first released at the end of October 2015. Comparing Samsung Electronics' stock prices at the end of November 2018, when this was completed, it rose 52.5%. But if you look at the situation at the time, it's different from gold. As business conditions recovered, it was on the upward side, and in 2017, when Samsung Electronics took out its own stock purchase card, as you may remember, it was the first time it exceeded 50 trillion won in annual operating profit since its foundation. It means that the performance was good. That's why experts analyze it like this. Let's listen to it.

[Yum Seung-hwan / Director of LS Securities: The performance is the most important thing for the stock price to continue to rise. It's called Samsung Electronics' crisis and it's a system problem. But these things haven't been solved yet. I just bought back my own shares and it's still not known if I've supplied Nvidia yet. Also, most of them believe that the semiconductor industry will not be so good until the first half of next year.]

Therefore, it is interpreted that performance is important, but the performance itself is not yet known, and the industry itself is not so certain internally. On top of that, the growth rate is said to be a bit better than last year, when the semiconductor industry was at rock bottom, but it is not certain. So, what we can see this time is that the stock purchase was more willing to support the stock price than expected, so it can have a positive effect. That's right. The event this time. Therefore, it seems that we can judge whether it really worked or not only in the second half of the year.

[Anchor]

Purchases to boost stock prices are good, but more fundamentally, we should hope that corporate values and visions go up together.

[Reporter]

I think you're talking about value investing.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Economy

More- Traditional liquor is going on 'K-Wind'...But the reality is "David and Goliath." [Anchor Report]

- [Issue Plus] Korean Won's Value, Stock Price Fall by 9%...KOSPI bounces 2 percent

- Samsung Electronics Co., Ltd.'s KOSPI and KOSDAQ Rise Together

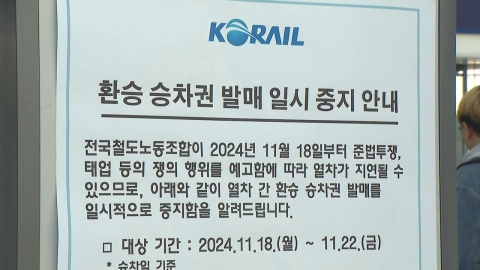

- The railroad union is expected to delay the operation of the subway on the way home from work.

![[G-Star 2024] 210,000 people visited G-Star, "Successful Finishing"](https://image.ytn.co.kr/general/jpg/2024/1118/202411181130300591_h.jpg)

![[G-Star 2024] HiveIM's first outing raises expectations for new works](https://image.ytn.co.kr/general/jpg/2024/1115/202411151733271198_h.jpg)