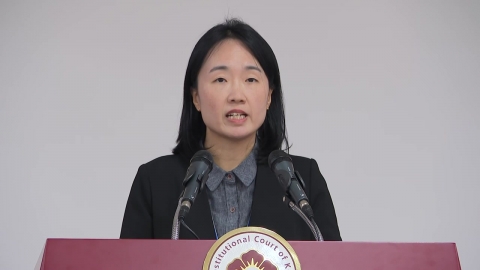

□ Host: Attorney Jo In-seop

□ Cast: Attorney Jeong Du-ri

* The text below may differ from the actual broadcast content, so please check the broadcast for more accurate information.

◇ Lawyer Cho In-seop (hereinafter referred to as Cho In-seop): Lawhouse for you, with lawyer Jung Du-ri.

◆ Lawyer Jung Du-ri (hereinafter referred to as Jung Du-ri): Hello, I'm lawyer Jung Du-ri of Shinsegae Law Firm.

◇ Cho In-seop: Let's first meet the people who visited the counseling center today with their stories about what kind of concerns they have.

□Sayers: My parents were big farmers and bought real estate when they had money. He worked together, but because my father was patriarchal, I had a bad relationship with my mother. Then, my father collapsed due to cerebrovascular disease and moved between university hospitals and nursing homes. I mainly took care of my father, and my younger brother and mother didn't come to the hospital very often. As time went by, my father's symptoms got worse and worse. My father didn't express his opinion properly, didn't recognize his family and died in a hospital bed without cognitive ability. After the funeral, I found out that my father's property, which had a lot of real estate, disappeared with only one apartment left. There were very few deposits left. I looked into it through the heir's property inquiry. I also learned that my father gave several properties to my younger brother during his lifetime, and that the real estate market price has risen considerably in the meantime. In addition, he also discovered the transfer of hundreds of millions of won to Olke. Something that happened before suddenly came to mind. My younger brother and his wife took my father's seal, resident registration card, and bank account and didn't return it. I filed a court trial against my mother and younger brother for the division of inherited property. Then, the mother farmed with her father, raised her children and supported her parents-in-law, and requested that 50% of the contribution be recognized. Is your mother's claim for contributions accepted? Also, is it possible for my brother to include the property he gave to his father without anyone knowing and the money transferred to Olke in his inheritance?

◇ Cho In-seop: Does the property donated by a father who is not cognitive include in the inherited property that should be divided?

◆Jeong Du-ri: The request for a divisional trial of inherited property is a division method that is requested to the Family Court when the division is not negotiated between the joint heirs. In order to divide the inherited property, it is necessary to specify what the inherited property is. Even if the property is already donated during the lifetime, even if the gift becomes invalid, it can be registered as invalid and remain as the property of the heir's father and be included in the inherited property.

◇Join-seop: What are the reasons for the gift to be invalid

◆Jeong Du-ri: Gifting is a contract, and you need some skills to make a contract, and one of them is the ability to communicate. The ability to make a decision is the ability to determine the effect of an expression of intention made by a person. According to our court, if the heir does not have the mental ability or intelligence to reasonably judge the legal meaning and outcome of the gift based on normal recognition and foresight at the time of signing the gift contract, the gift contract is invalid. Registration due to this is also invalid without a legitimate cause. Therefore, even if the father, who did not move his limbs well and was unable to express his intention, signed a gift contract, he could not be considered to be able to communicate, so the contract is invalid and the gifted property may be included in the inherited property to be divided.

◇ Cho In-seop: How can I judge that I don't have the ability to be a doctor?

◆ Jung Du-ri: It's also necessary to prove that your father has no ability to speak, and because if he becomes incapable, the legal act can be nullified, it seems that the court usually requires a fairly high degree of proof. In order to prove this, you can receive a copy of your father's medical records through the court and judge whether your father has the ability to speak through an appraisal procedure on the copy of medical records.

◇ Cho In-seop: Is the special income included in the money taken by the spouse, not the co-inheritor?

◆Jeong Du-ri: To determine the specific portion of inheritance in the request for the division of inherited property, calculate that it is deemed inherited property. Inheritance property is literally 'considered' as inherited property and is the basis for calculating the inheritance share. The deemed inherited property is calculated by adding the special income from the inherited property at the start of inheritance of the heir and subtracting the contribution from it. When the deemed inheritance property is determined, it is divided into legal inheritances to determine the specific inheritance. The Korean Civil Code stipulates that if there is a joint heir who has received a gift or bequest of property from the heir, if the gifted property does not reach his or her inheritance, there is an inheritance within the limit of the deficiency. In the end, in order to ensure fairness between heirs, if the joint heir appears to have received the inheritance from the heir in advance, this is considered as a special income and taken into account when determining the specific inheritance. For example, marriage preparation funds and independence funds that the father donated to his sister while he was alive can also be special profits in some cases. In principle, it cannot be a special profit because hundreds of millions of won was transferred to his wife, not to his brother, who is a co-inheritor. However, if it is recognized that our precedent is not different from the direct donation from the heir to the heir, gifts or bequests made to the heir's direct descendants, spouses, and direct descendants may also be considered as special profits (the Supreme Court decided on August 28, 2007). In the case of the sender, considering that his brother's wife received hundreds of millions of won from his father, that it has been paid since his father collapsed, and equity with him, even if it is not received directly by his brother, it can be evaluated as his special income.

◇ Cho In-seop: Then, is the contribution of a wife who cared for her husband always recognized?

◆Jeong Du-ri: The Civil Code recognizes contributions to the co-inheritors when there is a person who specifically supports the heir or has specifically contributed to the maintenance or increase of the heir's property. If there is a contributor among the joint heirs, the contribution deducted from the property value of the heir at the time of commencement of inheritance shall be regarded as the inherited property, and the inheritance calculated according to the legal inheritance shall be the individual inheritance. At this time, in the case of contributors, the inheritance is calculated by adding the contribution. If a spouse lives with the heir for a long time and cares for the heir, intangible contribution from cohabitation and nursing can be actively considered as one of the factors that recognize the contribution. However, in order to recognize the contribution to these spouses, it is necessary to determine whether the spouse's cohabitation and nursing go beyond the primary support obligation between the couple and reach special support, and whether there is a need to adjust the spouse's inheritance in order to promote practical fairness between joint heirs (the Supreme Court decided on November 21, 2019 by the 2014s44, 45 en banc Decision) In the case of the sender, if it is difficult to say that the mother of the sender specifically supported her father beyond the fulfillment of the primary support obligation between the couple, the mother's claim for the contribution is likely to be dismissed.

◇ Jo In-seop: Now, to summarize the contents of the consultation so far... Even if it is a real estate given by a father who has no cognitive ability during his lifetime, it can be included in the inherited property if the gift becomes invalid. If your father didn't have the normal ability to make a donation at the time of the donation, the contract will be invalid. The father's lack of medical ability must be proven through medical records and appraisal procedures. The money Olke received is not a special income in principle, but it can be evaluated as a special income for his younger brother given his relationship with the heir. If it is difficult to say that the mother specifically supported her father, the contribution claim is likely to be dismissed. So far, I've been with lawyer Jung Du-ri of Shinsegae Law Firm.

◆Jeong Du-ri: Thank you.

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Society

More- National Security Office Chief Shin Won-sik is summoned by a special police team.

- The military is not going to stop the arrest of the security..."No more troops".

- [Breaking News] "Violation of the Political Fund Act" is dismissed.

- Is the president's arrest imminent?Considering the timing of the collaboration

![[Chatting] 父 who didn't have the ability to recognize, gave it to a number of real estate younger siblings...Will the contract be nullified?](https://image.ytn.co.kr/general/jpg/2025/0109/202501090719439327_d.jpg)

![[Green] "Pick Meju with red beans"... Expansion of technology transfer for 'national patent'](https://image.ytn.co.kr/general/jpg/2025/0109/202501092117582707_h.jpg)

![[Interview] "Appear without watching the scenario"..."Squid Game" where Lim Si-wan jumped in.](https://image.ytn.co.kr/general/jpg/2025/0109/202501091742321870_h.jpg)